Fluorine-18 (18F)

January 13, 2024

Properties:

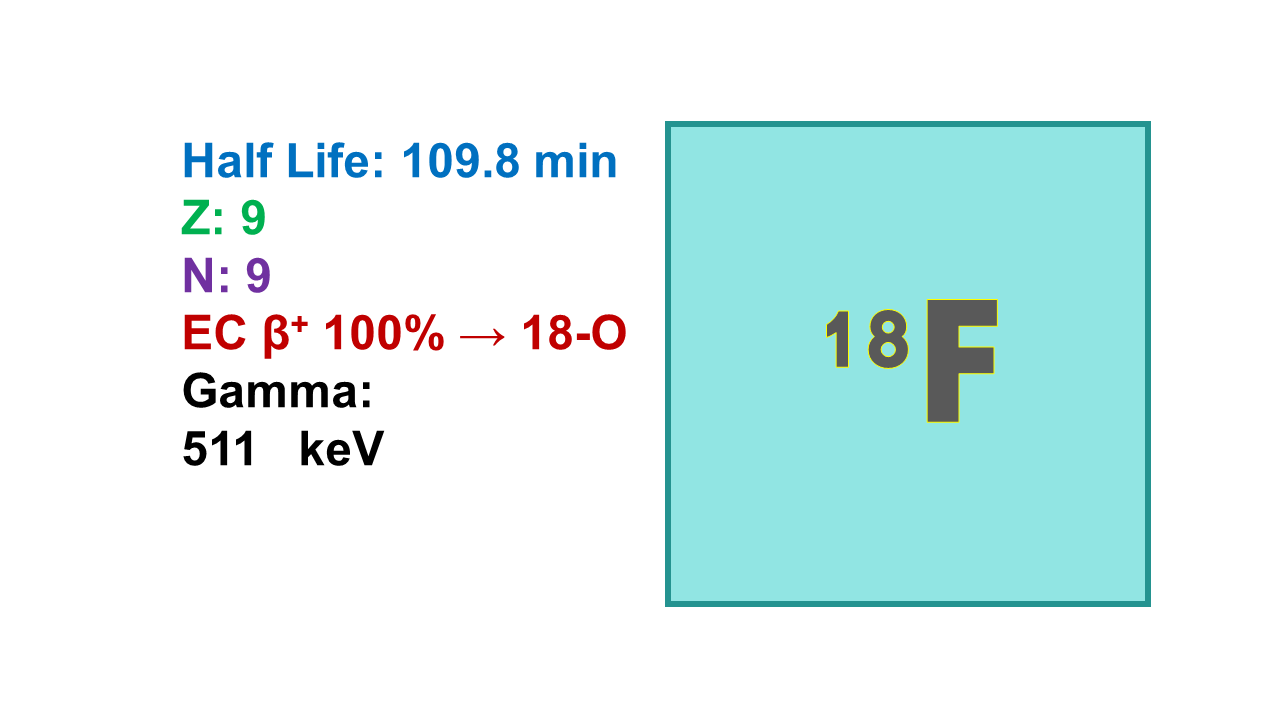

Fluorine-18 (18F) is presently the most used PET imaging radionuclide. It is an almost pure β+ emitter (97%) with only 3% EC and 109.8 min half-life. It emits positrons at 633 keV (maximum range 2.4 mm; average emission is 248 keV), annihilation of which produces two gamma rays at 511 keV. 18F decays into stable oxygen-18. Tenth value layer (TVL) is 11.5 cm for concrete and 13.7 mm for lead.

Manufacturing:

18F is easily produced by proton irradiation of oxygen-18 enriched water via the reaction [18O(p,n)18F] at 5–7 MeV, ideally regarding the cross-section, but yields are improved with only minor side-products when energy is increased up to 20 MeV. The small cyclotrons (5-10 MeV) cover the right energy to produce this radionuclide but the standard higher energy cyclotrons (10–20 MeV) are more adapted when larger amounts of bulk 18F are required. The fluorine is obtained in the form of the fluoride ion, allowing introduction of this halogen into any organic molecule via the nucleophilic process. Another route of production of 18F is the [20Ne(d,α)18F] route which provides fluorine gas allowing the introduction of fluorine into a molecule through the electrophilic way (this process can be difficult to control when larger amounts are needed). An alternative route starting with oxygen-18-enriched oxygen gas instead of enriched water can also generate electrophilic fluorine. The three methods need different starting material, different targets, and protons or deuterons, but the same cyclotron can do the work providing it is equipped with the specific material. Actually, all the standard manufacturing centers are able to produce nucleophilic fluorine via the irradiation of enriched water and all new 18F-labeled products should be synthesized via a nucleophilic procedure if the developer targets worldwide distribution.

Source and availability:

With a half-life of almost 2 hours, it is reasonably possible to ship fluorinated compound doses at 4 to 6 hours transportation distances (time including traffic jams, weather conditions and waiting times). Cyclotron-equipped manufacturing centers are implemented in the middle of the highest density of PET cameras areas in order to minimize the decay due to transport time. 1,484 cyclotrons have been reported in the most recent MEDraysintell report on equipment (March 2020) and constitute the presently installed worldwide base able to produce fluorine-18. The true 18F manufacturing network, i.e., the sites that have at least the local authorization to produce [18F]-FDG, remains below 900. It is expected that this cyclotron installed base will reach 1,550 by 2025 and that the number of GMP-approved centers will continue to grow, but probably without going beyond 1,100 GMP sites by that time. All other centers are able to produce 18F but only for research purpose. However, the distribution of cyclotrons is not even, as there are still some areas, and even countries (majority African countries, some Asian and South American countries) that still have no access to PET while in some wealthy and crowded populated areas, there are centers and cameras in excess. There is still a need for investment in this sector, but the evaluation must be made on a small-scale geographic basis.

The maximum capacity of production is directly linked to maximum current available for each cyclotron but usually the larger (and therefore, more expensive) cyclotrons have also the potential for higher currents. The number of doses of 18F-labeled tracer that can be produced per batch is of course linked to the capacity of 18F production and the yield of the synthesis, but above all to the average distance from final customers. The cyclotrons have been presently built in a way to be as close as possible to the customers, explaining the high number of manufacturing centers in highly populated areas, but a new model is under evaluation in which high-capacity cyclotrons produce exceeding high amounts of 18F solutions (tens of curies) that are dispatched to remote radiopharmacies closer to the final customers which will perform the radiopharmaceutical syntheses. The decay of the low cost 18F allows a better profitability if taking in account the reduced number of cyclotrons needed to reach the same number of final customers.

Among the starting material that can be relevant to consider as it impacts CoGs, one should not forget the 18O-enriched water (see below), the price of which fluctuates depending on supply and demand. During the year 2019 the price remained in the range of EUR 25–40/ml – US$ 30-45/ml when bulk material (list price is above EUR 200/ml). Between 2 and 3 mL enriched water are needed per target and per produced batch of 18F. In the past the enriched water price had fluctuated between EUR 25/ml (US$ 28/ml) and over EUR 500/ml – US$ 550/ml (the highest prices at the very beginning of the industrial FDG story reached EUR 1,400/ml – US$ 1,520/ml). Density of 98% 18O-enriched water is 1.11 at room temperature.

Derivatives:

The profile of 18F (short half-life, low energy) makes it ideal for imaging. 18F can be bound covalently to any organic molecule and some new chemical procedures have been developed to allow a very fast coupling chemistry with high yields (quick chemistry) or to improve large molecule and antibody labeling (aluminum fluorine complexes) or even to perform this chemistry in aqueous media. The aluminum fluorine complexes “AlF” do even have the size to fit in standard chelating agent for metals such as DOTA, allowing attaching fluorine in a non-covalently bound way to vectors. Most of the PET imaging molecules that have a worldwide marketing authorization were up to now based on 18F only. With the development of new radionuclides, new PET imaging agents are now labeled with 68Ga, 89Zr, 64Cu or 124I. The two first 68Ga-labeled molecules came on the market in 2016 and additional new PET molecules labeled with 68Ga as well as 89Zr are expected between 2020 and 2024. Other PET imaging agents with simple structures (non- vectorized) have only obtained local authorizations including 82Rb-chloride, 15O-water, 13N- ammonia and 11C-Choline.

The development of the PET industry started with the commercialization of 18F-FDG and was at the origin of the creation of the PET manufacturing network. FDG still represent 95% of the use in PET imaging and all cyclotron-equipped PET manufacturing centers have been and are presently built primarily for producing 18F-FDG. Presently there are only five non-generic molecules labeled with 18F on the market with a marketing authorization, 18F-Florbetapir, 18F-Florbetaben, 18F-Flutemetamol, 18F-Fluciclovine and 18F- Florapronol. Next to 18F-FDG, generic 18F-labeled products that have obtained a MA in at least one country include 18F-FDOPA, 18F-Sodium Fluoride, 18F-Fluorocholine, 18F-FET, 18F-FLT, 18F-FES, 18F-Fluorothymidine and 18F-FPCIT.

The 110 min half-life of the 18F tracers makes it impossible to obtain a pre-injection sterility test result at the time of injection. Therefore, the sterilization method for fluorinated compounds is filtration, but some companies have now succeeded in providing processes in which terminal sterilization is made possible (e.g., SteriPET for FDG, GE Healthcare). This complies in a better way with the different Pharmacopeias but is not always possible with all 18F-labeled compounds.

Price:

There is no real market price for 18F, as the radionuclide is immediately transformed into the labeled product. So, one can more easily estimate the cost of goods of a ready-to-use fluorinated dose. In fact, the CoGs mainly depends upon the cost of the staff (which is country dependent) and roughly, if one integrates also the raw material costs and the amortization of the site, a batch of 18F costs between EUR 2,000 and EUR 4,000 (US$ 2,200 and 4,400). The CoGs of the unit dose will depend upon the yield of the reaction and the distance to the customers, as each customer usually receives the same dose to inject (dose at ART) independently of the distance to the cyclotron. A profitable model shows that about 25 doses derived from a single batch bring the single dose CoGs between EUR 80 and EUR 160 (US$ 100 and 210) without transport. Unfortunately, very often centers produce less than 15 doses, doubling these CoGs and explaining both the high sale prices in some areas and the bottom-line price. For final labeled products with sales price below EUR 200, profitability can be expected only on volume.

Issues:

Due to its short half-life, 18F must be considered as a local radionuclide (distance of distribution corresponding to less than 6 hours transport condition).

Worldwide access to any labeled molecule needs access to a network of manufacturing sites covering the whole targeted market (this network still does not exist) and the implementation of the manufacturing process at each of these centers.

The manufacturing authorization needs to be obtained for each of the manufacturing center which makes any implementation and launch of a new 18F- labeled molecule an expensive business.

Existing manufacturing centers have limited capacities in terms of total amount of fluorine to be produced (in the range of 10–20 Ci per site daily if one takes into account the working hours of hospitals) and four to six molecules (if one plans to produce each of these molecules every day).

Comments:

18F is a quite expensive radionuclide to produce because cyclotrons have limited capacities. Due to the short half-life of 18F (less than two hours), fluorinated compounds can be used only with cameras located less than 5–6 transport hours away. A rough extrapolation based on a maximum of five centers to cover a country the size of France, the UK or Germany leads to a theoretical need of about 120 manufacturing centers allowing global access to the big markets including North America, Europe, Japan and some crowded Asian places. Another 100 centers will be needed to reach the more remote places, but these centers will barely be profitable. This network is close to completion, while crowded areas have over-capacity and are exposed to strong competition. On top of this all the already existing centers are limited in terms of number of molecules to be manufactured in parallel. The requested GMP level is not available in older centers.

On average, existing centers cannot produce more than four to six molecules daily and at the same time because they are limited in terms of space but mainly because all customers want to use these molecules during the same time slots. More than a dozen molecules are under clinical development phase II and III and if only half of them obtain a marketing authorization, the existing cyclotron network will be saturated by 2020-2024. In other words, there will be a need to start building another PET network by that date. The average cost of a PET production center with cyclotron is about EUR 5 million – US$ 5.5 million (EUR 4–7 million – US$ 5.5–8 million, depending upon the country), so an investment of more than EUR 500 million (US$ 550 million) will be needed by 2024 or earlier to give market access to these new molecules that are under development.

An alternative to 18F would be 68Ga, but the community has hesitated too long before showing a high interest in this radionuclide and 68Ga-labeled molecule just start to reach the market (68Ga-DOTATATE, 68Ga-DOTATOC) and others are explored in more advanced clinical developments. There will probably be at least 10 other years to wait before 68Ga labeled molecules will start to jeopardize the 18F molecules market. This means that 18F will remain the major PET emitter for the next 15 years and we will need cyclotrons at least until 2035.

Very few cyclotrons are equipped with the target for fluorine gas manufacturing and the upgrade of existing sites with this technology would cost a fortune. So, future fluorinated molecules will need to be produced by the nucleophilic route otherwise their development is engaged in a dead-end process.

Precursor sources:

The cyclotron production of 18F is based on the irradiation of 18O-enriched water. 18O is a natural stable isotope of oxygen. Natural water and air contain 99.76% 16O, 0.04% of 17O and 0.20% of 18O. The separation of 18O-water from natural water follows a complex and tedious process to gain the minimum required 97% enrichment in 18O. The distillation or rectification process takes place over a fractionating column made of thousands of distillation plates and needs more than 6 months to reach equilibrium, allowing the beginning of a separation of the products. Actually 16O-water and 18O-water show a difference in boiling point of less than 0.2°C. When the equilibrium is reached, the unit produces continuously the final product, but increase of capacity can only be obtained by building a second unit.

All manufacturers but one (Sanso), are producing 18O-water by distillation of natural purified water. Sanso extracts 18O by cryogenic distillation of ultrapure liquid oxygen gas and recombines it with hydrogen to obtain the 18O-labeled water.

In January 2021, Japanese researchers published a paper in Nature in which they demonstrated that 18O can be easily separated from 16O by using a specific nanoporous carbon. 18O is preferentially adsorbed and separated from 16O, allowing an economically more interesting route to produce this isotope. Apparently, the technology is also valid for separating carbon and nitrogen isotopes. At this stage, there is no industrial project based on this new technology. Actually, regarding 18O, it would not really make sense investing in such new technology, as all existing production units are now amortized and there is already high competition due to worldwide production overcapacity.

The cGMP manufacturers of 18O-enriched water include the following companies:

Cambridge Isotope Laboratories Inc. (CIL), Andover MA, a US company, now subsidiary of Otsuka Pharmaceuticals, Japan. CIL sells water in Europe through its subsidiary Euriso-Top, Saclay, France, and owns also the German company ABX GmbH, located in Radeberg. The 18O-water production site is located in Xenia, OH with a capacity of 425 kg/year. – www.isotope.com;

Center of Molecular Research (CMR), Moscow, the Russian source of enriched water – http://www.isotope-cmr.com. The manufacturing site is located in Sosnovy Bor, near St Petersburg, Russia (previous name of the company was Global Scientific Technology GST). Production capacity is around 80 kg/year;

Huayi Isotopes Co (HIC), Changshu City, Jiangsu, China, a subsidiary of Huayi Technology Co. Ltd, a Chinese source of enriched water. Huayi’s capacity in production of 18O-water is presently about 50 kg. – www.huayi.de. Isoflex USA http://www.isoflex.com/products/specialties/oxygen-18 was previously the distributor in the USA of the Russian originating water, and now distributes Huayi’s water;

Iason GmbH, an Austrian company that produces its own water and has probably also the lowest capacity (below 40kg/y) from all manufacturers (see full description of Iason GmbH below) – http://www.iason.eu/ Iason water is only for own usage and close customers; This is now (2021) integrated as a Curium company

Isotec USA (In-Situ Oxidative Technologies, Inc.), http://www.insituoxidation.com/ is a very small US company that continues to produce on the basis of the nitrogen oxide process, but their capacity is very limited (less than 20 kg/y) and their production is mainly sold through Sigma-Aldrich

Marshall Isotopes Ltd, in Be’er Tuvia, an Israeli company now owned by Advanced Accelerator Applications SA (AAA – see full description of AAA below) – www.marshall-isotopes.com. The company announces 100 kg annual capacity, but probably stays within a 60 kg range in average;

Rotem Industries Ltd, an Israeli state company with a production capacity of 250kg/year. CortecNet (http://www.cortecnet.com) is a distributor of Rotem water in Europe – www.rotemi.co.il and http://www.rotem-medical.com;

Shanghai Research Institute of Chemical Industry (SRICI), Putuo, Shanghai, China – production capacity of 100 kg/year to be extended to 200kg/year in a near future www.oxygen18.com.cn;

Taiyo Nippon Sanso Co, a Japanese company, specialized in the production of gases, produces 18O-gas and transforms it in 18O-water. Sanso is already the

largest manufacturer of 18O-water and has increased its original production capacity of 300kg/year to 600kg/year by beginning of 2016. http://stableisotope.tn- sanso.co.jp/english/18O-Product/PET_01.html. Sercon is a distributor of Sanso water (https://serconlimited.com/).

In April 2020, AEOI (Iran) started its distillation unit of Khandab nuclear center for the production of 18O-water, adding a new large size manufacturer (which is presently limited in terms of export for political reason).

The company PETLabs in South Africa did also build its own unit of production of 8O-Water which is operational since 2019.

Distillation of nitrogen oxide was also developed in the 90s but never reached high- capacity and the process was at risk of explosion. Companies such as ICON Isotopes USA (http://www.iconisotopes.com), Isonics USA or ISI Tbilissi, Georgia (water sold through the Nukem channel), are not anymore involved in the production of highly enriched 18O-water (there is a market for low enriched 18O-water for non-nuclear medicine applications).

Small amounts of water can also be obtained from distributors such as CortecNet, Nukem, Sercon, Sigma-Aldrich, Novachem (in Australia), Isonics, but these companies are not manufacturers and rely on the above listed sources.

Very recently, the Russian company Rusnano has announced its intention to become producer of its own 18O-labeled water at the same time the company opened its two first PET production centers in Russia.

Yearly production capacity of these manufacturers ranges from less than 50 kg (Iason), to several hundred kilograms (CIL, Sanso). With the recent increase of capacity of the Japanese source there is no risk of shortage within the next 8 to 10 years. Total worldwide capacity is presently around 1,700 kg/year. Low enriched 18O-water (less than 10% enrichment) can be used in other non-PET applications such as obesity diagnostic tools. The figures provided here are taking only in account the highly enriched water capacity (>97% enrichment). The needs of highly enriched water for the year 2020 for fluorine production are estimated at about 1,600 kg/y and could grow to 1,800 kg/y by 2025.

Due to the potential price fluctuations of the water, large PET manufacturers have already built long term stocks. Sizes of these stocks are unknown but could be evaluated at half a year of needs at least.

Also, more than 60% of the water used in targets can be recovered after irradiation. It is contaminated with metals, organic material, also some low level of tritium, and it has a lower enrichment level. The tritium 3H impurity is produced during 18F production as a side-reaction via [18O(p,3H)16O]. The recovered water needs to be purified, which is possible but makes sense only in larger volumes. Presently individual stocks of used water are collected by manufacturers which propose to recycle this water, but the largest amount remains stored and not reprocessed (removing tritium is not obvious, but with only

12.33 years half-life, the problem resolves by itself, over time). The US company Isoflex has put in place a 18O-water recycling program offered to companies and institutions. There is also a high demand for water enriched only at 5% for other medical purpose. Such a quality of water can be gained by diluting low enriched water recuperated from the PET manufacturing centers.

The 18F-manufacturing network:

Table 49 provides the names of the companies owning and running more than one cyclotron that can be considered as a starting point of a network. Centers not listed here are monocenters which do not necessarily follow the cGMP rules, or remain pure research centers.

When the first companies invested in cyclotrons, they implemented their sites in the most crowded area with the expectation that the number of PET cameras would also be implemented in all hospitals in the vicinity. The competition resulted in the implementation of additional centers in the same towns, while other areas remained under-equipped. In some very crowded areas (e.g., Paris, London), some centers have been put on hold due to the disproportionate price competition and the excess local production capacity. These centers are not to be dismantled and can be reactivated any time, in particular when new fluorinated molecules will come on the market.

In order to save money in investment, another model could have been developed. A high- capacity cyclotron could produce very large amounts of 18F that are shipped to remote radiopharmacies able to manufacture the final labeled compound at pharmaceutical quality. This model was never implemented as at the time it made sense, the competition and the number of active centers was already too high.

A new model was recently introduced that solves the problem of access to expert staff. The central manufacturing site produces very high amounts of the final radiolabeled compound. The 18F batches from several cyclotrons are pulled to prepare a single batch of the fluorinated tracer. As the cost of goods sold mainly depends on the cost of staff, for the same price such a center generates an excess of doses that can be shipped at very long distances, providing the final sale’s price at least covers the transport costs. The excess is considered as 100% profit. In this model only one team for manufacturing is needed and one single marketing authorization must be obtained. It also considerably reduces a major risk, the one linked to the success of winning tenders. Fluorinated compounds are sold to hospitals on a yearly basis and if the number of doses to be produced remains below profitability, the contract obliges the manufacturer to provide these doses at a loss, the center cannot be shut down temporarily and the staff needs to be paid for the full year.