Iodine-123 (123I)

January 17, 2024

Its nuclear properties are also almost ideal for SPECT studies. In parallel, the radionuclide 123I is a halogen and thus a very useful analog label for creating radiotracers.

Properties:

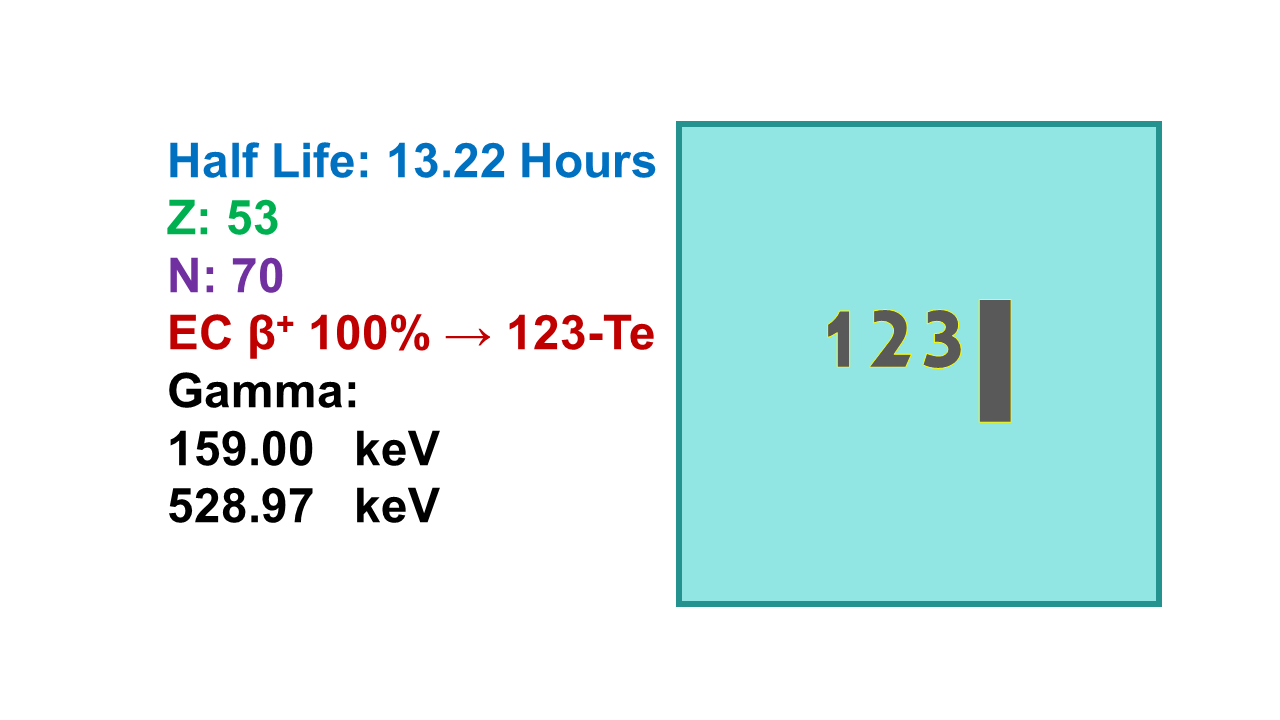

Iodine 123 (123I) is a SPECT radionuclide with a half-life of 13.22 hours. It emits its gamma (γ) at 159 keV (83%) and a beta (β-) at 1,075 keV (97%). Tenth value layer (TVL) is 2.0 mm for lead.

Manufacturing:

About 25 different nuclear processes have been investigated for the production of 123I. The development of an optimum process is a good example of the changing demands on the quality of medically important radionuclides. At low-energy cyclotrons the 123Te(p,n) reaction over Εp = 14.5 → 10 MeV is applied, and at medium-energy cyclotrons the 124Te(p,2n) process over Εp = 26 → 23 MeV. In either case highly enriched target material is used.

The isolation of 123I is carried out via dry distillation from the irradiated TeO2 target. The third route of 123I production consists of the 127I(p,5n)123Xe → (EC,β+) → 123I process. The optimum energy range for this nuclear reaction is Εp = 65 → 45 MeV, needing a higher-energy cyclotron. Interestingly, an iodine target (NaI) is used to produce a radioiodine product. Here, first the proton-rich short-lived radionuclide 123Xe (t½ = 2.1 h) is formed. It instantaneously generates 123I via electron capture and β+ routes. The radioxenon is collected into a separate vessel and is allowed to transform for about 7 h during which period the maximum growth of 123I occurs. The 123I formed is removed from the vessel, containing radioxenon. This is a relatively high-yield process and the only impurity observed is 125I (≈ 0.25%).

The fourth route is even more complex. It consists of the 124Xe(p,x)-process. Highly enriched and very expensive 124Xe gas is needed,11 but it requires only a medium-sized cyclotron. This process leads to 123I of the highest radioisotopic purity. Proton irradiation of Xenon-124 provides 123I indirectly via two different routes: [124Xe(p,2n)123Cs]→123Xe→123I and [124Xe(p,n)123Xe]→123I at 22–30 MeV. Iodine is easily separated from the Xenon gas by freezing. Another effective manufacturing route has been explored by the LANL, based on Tellurium-123 [123Te(p,n)123I] at about 14-15 MeV with a separation by iodine sublimation. These solid targets are commercially available (IBA), but the production capacity with a 16-18 MeV will be limited to less than one curie after a few hours of irradiation. For large scale production the cyclotron route based on Xenon is the only economically viable route.

Source and availability:

123I can only easily be produced via larger cyclotrons (ideally 30 MeV) and will remain expensive. Moreover, the network of specific 123I-producing cyclotrons (>24 MeV) does not cover the major worldwide markets yet. The situation is similar to 111In as both radionuclides need the same cyclotron network. The shorter half-life of 123I (13.22 h compared to 2.8 days for 111In) makes the situation even more complicated.

123I is available on an almost daily basis from suppliers such as Nordion Inc./BWXT, Mallinckrodt (Curium) and GE Healthcare. IBA Molecular (Curium / French site) has recently reduced its manufacturing capacity to a limited number of batches per month. On the other hand, Pars Isotope (Iran) produces 123I and in 2013, the company started evaluating its exportation to Germany.

Derivatives:

Any injected, inhaled or swallowed iodine atom goes straight to the thyroid. This unique property of an atom is of course exploited in the imaging and therapy of any disease affecting this gland, including thyroid cancer. 123I, like 131I, is used for imaging of the thyroid, but has the advantage of lower dosimetry to the patient than 131I. The amount of swallowed iodine (usually in capsules) for this imaging test (2–4 mCi) is tolerated by individuals who are otherwise allergic to iodine.

The counterpart of this specific thyroid property is that any iodine-labeled drug not targeting the thyroid must take into account the potential metabolism which can lead to release of free iodine. Iodine is a so-called labile atom (whose bond to the carbon atom is not very strong). To avoid capture by the thyroid of this free radioactive iodine, large doses of cold iodine have to be given to the patients before injection of the 123I-labeled compound in order to saturate the thyroid.

123I is the only SPECT radionuclide that can label molecules via a covalent bond and hence cross the blood–brain barrier (BBB). This property has led to interesting applications in neurology that are slowly being replaced by 18F-fluorinated compounds. Some applications of 123I are also limited by its short half-life.

Marketed 123I labeled molecules include 123I-Iobenguane (Adreview), 123I-Iodofiltic acid, 123I-Iodohippurate, 123I-Iofetamine (Spectamine), 123I-Ioflupane (FPCIT), 123I-Iomazenil and 123I-Sodium iodide. 123I labeled molecules under development include 123I-6-DIG, 123I-ADAM, 123I-Azedra, 123I-BZA2, 123I-CLR, 123I-IBZM, 123I-IMPY, 123I-Iometomidate, 123I-MIP-1072 and 123I-MIP-1095 (the Trofex program), 123I-NAV5001 and 123I-PE2I.

Price:

123I remains quite expensive (around EUR 50–70/mCi – US$55-78/mCi up to US$400/mCi at final customer in countries where 123I is scarce) as a consequence of the need for a high-energy accelerator. Individual doses of pharmaceutical-grade 123I-labeled tracers are all sold above EUR 800 (US$ 900). Only 123I-Sodium Iodide (for thyroid imaging) remains at lower prices than 111In due to the larger amounts that are produced.

Issues:

◼ Production only via high-energy cyclotrons.

◼ As a consequence, 123I will remain expensive.

◼ Competition with 124I and 18F.

Comments:

123I is currently the second choice of SPECT agent after 99mTc and before 111In. Any investor planning to develop a new tracer labeled with 123I with the intention to cover the worldwide market should first consider the investment in those missing manufacturing tools, on top of the remaining costs of development. On the basis of the existing centers, at least another five full GMP centers will be needed to cover the main markets. At about EUR 15 million (US$ 17 million) per unit, a minimum of EUR 75 million (US$ 83 million) investment will be needed to fulfill this request.