Gallium-68 (68Ga)

February 26, 2024

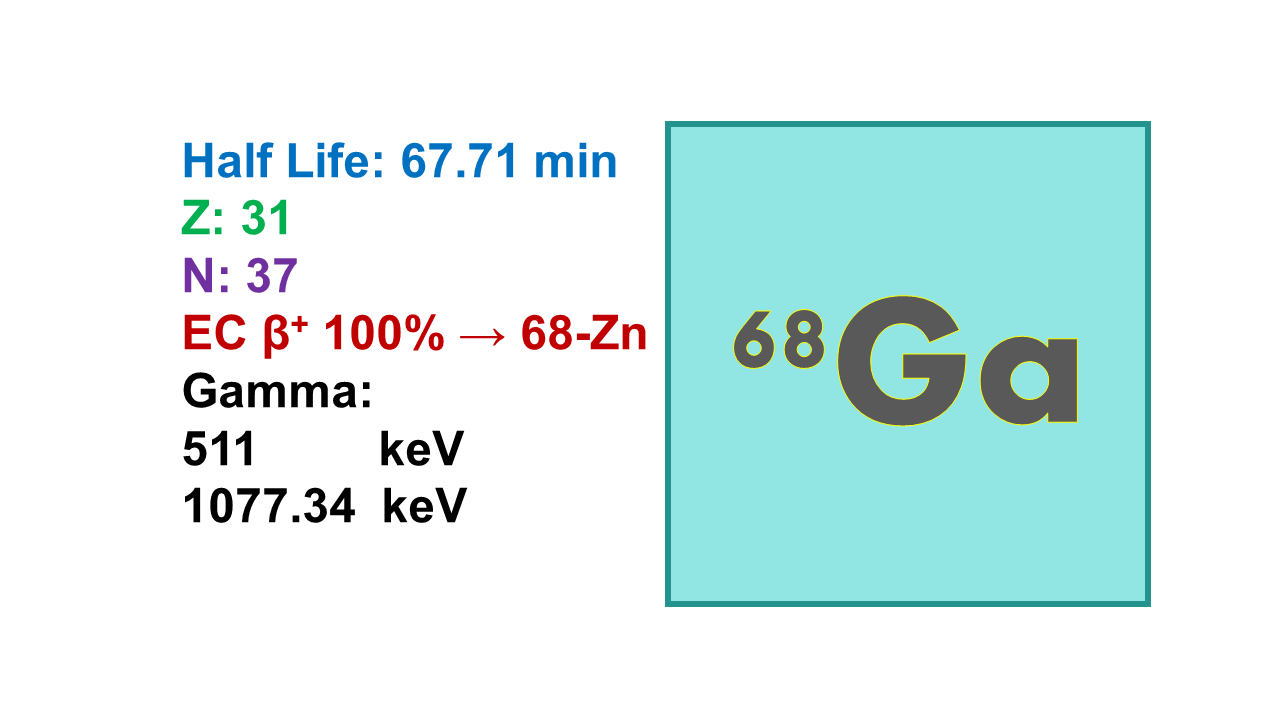

Gallium-68 is a positron-emitting radioisotope of the element gallium with a relatively short half-life of approximately 67.7 minutes. It is commonly used in positron emission tomography (PET) imaging for a variety of clinical applications.

Gallium-68 is typically produced by bombarding a germanium-68 target with a proton beam in a cyclotron, resulting in the formation of gallium-68 through the nuclear reaction germanium-68(p,2n)gallium-68. Once produced, gallium-68 is attached to a targeting molecule, such as a peptide or antibody, to create a radiotracer for PET imaging studies.

One of the key advantages of gallium-68 is its short half-life, which allows for the production of radiotracers on-site in PET imaging centers. This enables the use of freshly prepared radiotracers for imaging studies, leading to higher imaging quality and more accurate results.

Gallium-68-labeled radiotracers are commonly used in oncology for imaging various types of cancer, including neuroendocrine tumors, prostate cancer, and breast cancer. Gallium-68-labeled peptides, such as Ga-68 DOTATATE for neuroendocrine tumors, have shown excellent imaging performance and have become standard tools in clinical practice.

In addition to oncology, gallium-68 is also used in imaging infection and inflammation, as well as in neurology and cardiology research studies. Its versatility and favorable imaging characteristics make gallium-68 a valuable radioisotope for PET imaging applications.

Overall, gallium-68 plays a crucial role in molecular imaging, providing valuable information about disease processes and helping guide patient management and treatment decisions in various clinical settings.

Properties:

Gallium-68 (68Ga) is a generator- or cyclotron-produced radionuclide for PET imaging with a half-life of 67.7 min. The β+ is emitted at 1,899 keV (88%, average energy 500 keV), followed by annihilation producing two gamma rays at 511 keV. The decay product is the stable 68Zn (100%). Contrary to 18F which can be linked to organic molecules via a covalent bond, 68Ga is a metal and needs a chelating moiety to be attached to the vector.

Manufacturing:

Generator production:

68Ga is obtained from the decay of 68Ge (100% – t½ 270.95 days) making production from a generator possible. Major radioactive potential contaminant for 68Ga solutions is therefore, 68Ge and the breakthrough limit of 68Ge has been fixed (and confirmed by the European Pharmacopeia in June 2015) at 0.001%.

In June 2015, the FDA announced that a 68Ge/68Ga generator will, for the time being, not need a marketing authorization and only the 68Ga solution taken from this generator will have to be qualified as an API (Active Pharmaceutical Ingredient). The manufacturers must file a DMF for the API 68Ga produced from the generator (or cyclotron) which would then be reviewed in light of each NDA or ANDA filed by other manufacturers for kits to be labeled. The final PET radiopharmaceutical, resulting from the labeling of the 68Ga to the kit, would not be subject to PET cGMP or regulatory submission requirements. The FDA made the analogy that this radiopharmaceutical would not be any different from the formulation of any 99mTc kit. It still remains to define what needs to be covered within the DMF and what will be the responsibilities of the manufacturers and end-user in terms of final product validation. Eventually the FDA may request the filing of an NDA to obtain an MA for the generator when a 68Ga-labeled molecule with a MA will reach the market.

Direct accelerator production:

There are several approaches under development for the direct production of 68Ga with a cyclotron, by irradiation of zinc targets [68Zn(p,n)68Ga] at about 14 MeV. The 68Ga is of higher purity without 68Ge contamination. Literature data describe yields of about 25-100 mCi EOS, but in June 2015 the company NCM-US successfully developed a solid target able to produce up to 5 Ci of high purity 68Ga in less than 2 hours irradiation with a standard cyclotron. In October 2015, IBA announced also its new technology of producing 68Ga with a cyclotron and a liquid target. Official production levels published by IBA in October 2016 claim that 180 mCi of pure 68Ga solution can be obtained after 40 min irradiation at 45 µA in an 18 MeV cyclotron using a 100 mg 68Zn target in 3 mL nitric acid. GEH is exploring development of both liquid and solid targets. In July 2016, Comecer proposed a new tool able to produce 68Ga from a solid target, which can be adapted to any cyclotron. After irradiation the target is dissolved on site and bulk solution is transferred in the purification hot cell. So far, it looks like that the solid target is able to produce up to 25 times more 68Ga than the liquid target (about 2GBq/50mCi can be produced with the liquid target and under the same conditions up to 50 GBq/1.3 Ci with the solid target, in both cases 68Ge-free).

For the time being, this way of production will not jeopardize the generator market (the half life is short), but can be considered as an interesting alternative for private centers/hospitals that are already producing their 18F for in-house use only. Further exemple was published by end of 2020.

In November 2019, ARTMS announced that with its system, a record-breaking 68Ga production of 10 Ci per batch was achieved at Odense University Hospital. Additionally, multi-curie production of 68Ga-DOTATATE and a PSMA radiopharmaceutical were achieved. The Odense team is now embarking on a validation study in preparation for regulatory submission. Results were published in January 2021. The ARTMS system (transport of solid target and automated extraction of 68Ga from the target) is cyclotron manufacturer-agnostic and can be installed on any major cyclotron brand. This new real alternative to generators based on very high-capacity 68Ga-producing cyclotrons could become economically viable with existing cyclotrons and completely change the way 68Ga will become available. In January 2021, ARTMS announced a successful production of 2.5 Ci stable 68Ga-PSMA-11 (68Ga-TLX591-CDx) production batch in collaboration with Telix Pharma.

Actually, with the increase of generator prices in 2019 (EZAG EUR 125,000), alternative 68Ga production method become even more of interest.

Regarding regulatory authorities, 68Ga produced with a cyclotron can clearly be defined as an API, i.e., a pharmaceutical starting material used for labeling of kits.

Source and availability:

Presently there is no center proposing bulk 68Ga obtained with a cyclotron but with the new NCM-US, GEH, Comecer, IBA or ARTMS technologies it could be possible that large amounts of 68Ga solutions could become available within less than one year.

In May 2020, Telix Pharma signed an agreement with ARTMS Products in which ARTMS’ cyclotron technology will be used to produce high-activity 68Ga, which will then be validated for use with Telix’s production process for 68Ga-TLX591-CDx.

Derivatives:

68Ga has not proven useful as a simple salt for diagnostic usage, so only 68Ga-labeled compounds are of interest. Due to the short half-life of the radionuclide, the final product must be prepared on site or close to it. Labeled molecules are prepared with a synthesizer, and most of them need a heating step. New approaches based on cold kits are now available. Presently only 68Ga-PSMA-11 (ANMI/Telix Pharma) and 68Ga-THG001 (Theragnostics) are developed as a GMP quality cold kit, but none of these two kits does have yet a MA.

More than fifty 68Ga labeled molecules have been described in the literature by academics and used in humans at least once. However, most of them are adaptations of 99mTc equivalents and development has not been pursued mainly because of the lack of interest by financial partners, the absence of intellectual property and the limited interest in PET equivalent molecules. AAA has all rights for the 68Ga-DOTATATE which came on the market by 2016 in the US while 68Ga-DOTATOC was approved the same year in Europe. These two molecules are presently the only 68Ga-labeled tracers with MA. AAA has also the rights for the 68Ga-Annexin V (but apparently, prefers to continue developing 99mTc- rhAnnexin V-128). 68Ga-PSMA-11 is a generic but presently the most used 68Ga-labeled tracer. Among the molecules that could be developed further one can include 68Ga-RGD (68Ga-BNOTA-PRGD2, angiogenesis imaging), 68Ga-DOTA-exendin-3 and -4 (insulinoma), 68Ga-Galacto-RGD, 68Ga-ABY-025 or 68Ga-IPN-1070.

In the US, the development of 68Ga-labeled molecules followed a slow process compared to Europe. Initially it was thought that this situation was linked to the absence of approved generator. In fact, the US structure based mainly on private radiopharmacies, distant from the final customer, is not really adapted to very short half-life tracers. Most of the hospitals and clinics do not have as in Europe their own labeling unit and the associated staff. When the first 68Ga-labeled molecule (68Ga-DOTATATE) was introduced on the US market, this distribution structure was revisited as the accessible areas/hospitals from existing radiopharmacies were divided by two, due to the distance. This new network based on generators is now under competition in the US, with the building of a parallel network of cyclotrons that will produce bulk 68Ga.

68Ga LABELED TRACERS UNDER CLINICAL DEVELOPMENT

| Target/Mechanism | Molecule | Company | Issues – Comments |

| Apoptosis imaging | 68Ga-Annexin-V | Novartis/AAA | Apparently on hold (replaced by 99mTc analogue) |

| Bombesin receptor GRPR | 68Ga-NeoB | Novartis/AAA | Entered phase II clinical stage |

| Bombesin receptor GRPR | 68Ga-Bombesin 68Ga-RM2 (BAY 86-7548) | Piramal Imaging Life Molecular Imaging Alliance Medical | Apparently on hold |

| Bone metastases | 68Ga-DOTAZOL | ITM | Phase I/II |

| CXCR4 | 68Ga-Pentixafor | University of Munich | Phase I |

| Fibroblasts | 68Ga-FAPi-04 | Sofie Biosciences | Phase 0 |

| Folate receptors | 68Ga-EC2115 | Endocyte / Novartis | Phase I |

| GLP-1 | 68Ga-NODAGA-Exendin- 4 | Radboud University | Phase I/II Diabetis |

| HER2 | 68Ga-ABY-025 | Affibody | Phase I |

| Insulinomas | 68Ga-DOTA-exendin-4 | University of Basel | Early stage (68Ga replacing 111In) – analogue of GLP-1R |

| Integrin RGD | 68Ga-Alfatide II | Xijing Hospital | Phase II |

| Integrin RGD | 68Ga-BNOTA-PRGD2 | Beijing University Medicine College | Local development and availability – On hold |

| Integrin RGD | 68Ga-NODAGA-Theranost | Advanced Innovative Partners | Early clinical trial |

| Integrin RGD | 68Ga-Galacto-RGD | Generics | Different academic approaches without IP |

| Integrin RGD | 68Ga-NODAGA- E[c(RGDγK)]2 | Rigshospitalet Copenhagen | Phase 0/I IHD |

| PSMA/GCPII | 68Ga-P16-093 | Five Eleven Pharma | Phase I |

| PSMA/GCPII | 68Ga-PSMA-11 (ProstaMedix/ANMI/Telix Pharma) | Generic – Origin: University of Heidelberg (RadioMedix) (Cold kit: ANMI) | Phase II in the US Phase II in EU Approved in the US (UCLA and UCSF) – 2020 |

| PSMA/GCPII | 68Ga-PSMA-617 | University of Heidelberg | Phase I/II in EU, but development stopped |

| PSMA/GCPII | 68Ga-PSMAI&T or 68Ga-PSMA-TUM1 | University of Munich | Phase I/II in EU, but apparently on hold |

| PSMA/GCPII | 68Ga-PSMA-R2 | Novartis/AAA Johns Hopkins | Preclinical – 68Ga analogue of the 18F-PSMA-SR6 acquired in Q1/2016 by AAA |

| PSMA/GCPII | 68Ga-THG 001 (GalliProst™) | Theragnostics Ltd | Phase II |

| sstr | 68Ga-HA-DOTATATE | ||

| sstr | 68Ga-IPN-1070 | OctreoPharm / Ipsen Pharma | Under development Phase II in parallel to the 177Lu analogue |

| sstr | 68Ga-NODAGA-LM3 | Bad Berka Central Clinic | Phase I/II |

| uPAR | 68Ga-AE105 | Curasight | Phase I completed |

Price:

The price of a generator was quite high (about EUR 20–30,000 – US$ 22-33,000, EUR 34,400 for the 50 mCi IRE generator by mid-2017, even increased to EUR 45,000 by EZAG for a 50 mCi generator since this device obtained the MA), but suddenly exploded (above EUR 70,000 for both EZAG and IRE generators in 2018 and EUR 125,000 in early 2019) as a consequence of the huge demand, the lack of capacity and above all the huge increase (> 200%) of the price of 68Ge from Curium.

The price of an individual dose of 68Ga can be estimated on the basis of the following data: a 50 mCi generator shows a non-corrected yield of 82%, so when new, a generator can produce daily two batches of about 41 mCi 68Ga. This means 10 batches per week for 4 patients each, but only half of this amount after 271 days (half-life of 68Ge). Doses per patient will remain in the range of 5–12 mCi. In reality, number of batches are not limited by the customer’s capacity to use the generator but by the 68Ge breakthrough which leads

to led manufacturers to limit use of the generators to 250 elutions for the EZAG generator and 450 for the IRE-Elit generator. Optimized estimations can be based on an average of 3 patients per batch all over the year, but in reality, generators are presently used only for one or two patients per batch. On this basis, the individual cost of 68Ga comes to EUR 500 per batch for the EZAG generator or 312 for the IRE-Elit generator, or respectively EUR 170 or EUR 105 per patient on an optimized use basis (3 patients per batch). In the worst case, EUR 500 per batch or patient when only one dose is prepared per day.

The price of 68Ga could reach the same range of prices as 18F, in the optimized configuration, but not yet in the same range as the 99mTc dose price. Global prices of generators, and hence of 68Ga doses will considerably drop as soon as competition grows. The iThemba 50 mCi non-approved generator is available at US$ 18,000. ANSTO was selling its first generator at quite aggressive prices (less than EUR 15,000 for a 20 mCi generator) which shows in a certain way how could be the general trend of price decrease in a competitive environment. In a couple of years 68Ge will also be available from alternative sources, influencing also the overall CoGs. The bottom limit will be linked to these costs of 68Ge.

It is estimated that when competition will be in place, generator prices will drop to around EUR 30,000-40,000, (expected by 2023-2024) which brings the dose per patient (optimized scenario) down to EUR 40-55 and even EUR 25-33 for the IRE-Elit generator, therefore, highly competitive with 18F.

Cyclotron produced 68Ga price could be in the same order of magnitude than 99mTc price and highly competitive with 68Ga from generators, as we know now that the scaling up of the production has been successful.

Issues:

There is still some improvement needed in the chemistry of gallium, but this is not a major issue. Development of cold kits (no heating, ‘shake and inject’ concept, cf ANMI products) is progressing. Generators need to become available with higher capacity (up to 500 mCi generators are needed), as presently some customers and particularly the US centralized radiopharmacies, are already pooling the 40 mCi batches of several generators.

In absence of fast development of production capacity of generators, some developers are already considering substituting 68Ga in radiolabeled tracers by 89Zr.

Comments

68Ga is definitely the PET radionuclide of the future with its properties and way of use similar to its SPECT equivalent 99mTc. 68Ga is considered for PET, in terms of applicability, as the equivalent of 99mTc in SPECT. It could therefore, jeopardize the 18F-labeled molecules and associated radiopharmaceutical business. The realistic medium-term risk, however, remains very limited: 68Ga will probably take some shares of the 18F-labeled molecules and business, but in a selective natural and long-term way and only through the granting of marketing authorization for proprietary molecules. In fact, 68Ga cannot jeopardize 18F as it is financially and time-wise impossible to replace all 18F-labeled molecules by 68Ga-labeled equivalents. In the future (2020–2030) there will be tracers labeled with 68Ga coexisting with tracers labeled with 18F as often both imaging solutions cannot be possible/available with both radionuclides: once the development with one tracer is started, it will probably block the funding and interest for the development with the other radionuclide for economic reasons.

Despite the shorter half-life of 68Ga compared to 18F, one could consider an industrial model based on the cyclotron-produced 68Ga. With high-capacity production of 68Ga (several Ci per batch) and high purity shipment of doses of the final 68Ga-radiolabeled

tracer at up to 5 or 6 h distant sites is realistic without impact of image quality. If one takes in account that the final tracer will be produced on-site on the basis of cold kit and will need about 10 mCi of 68Ga, the overall process will need to take in account about 2 half- lives of the radionuclide in average and as a consequence each EOB Ci of 68Ga will allow to produce about 20-25 doses of the final product. With an estimated cost of production of EUR 3,000 per batch the model becomes economically viable if the price of 68Ga per dose reaches the level of the same dose obtained from a generator i.e., about EUR 30. In other words, a batch should be able to generate in average 100 doses which means on the basis of about 4-5 Ci per batch the model could become competitive with 99mTc-SPECT and highly competitive with generator produced 68Ga. Of course, like for 18F, local situations including closer customers, lower batch CoGs, but above all lower patient doses (below 10 mCi) could be even more favorable and reduce the minimum batch capacity down to 2 Ci.

In Japan, there is a growing interest in 89Zr aiming at substituting for 68Ga. Importation of radioactive material to Japan is very difficult and as there is no local production of 68Ge/68Ga generators, and no direct access to 68Ge, local industry has been considering substitution of 68Ga by 89Zr. Presently there are only three sites in Japan that obtained the authorization for handling 68Ge/68Ga generators, while large units of production of 89Zr are now under construction. Most of the non-18F-labeled PET tracers that will be available in Japan could be based on 89Zr only.

Additional comments regarding the different options in implementing access to 68Ga.

Over the past years, the use of 68Ga as alternative to 18F in the development of new tracers for PET took mainly off in Europe. Although in absence of tracers with marketing authorization, the routine use of 68Ga-tracers was therefore, mainly adapted to the European way to get access to radiopharmaceuticals. Most of the nuclear physicians are not aware that the industry providing radiopharmaceuticals is structured in a completely different way in the US compared to Europe.

In Europe and most of the non-US countries, each hospital has developed an access to a dedicated preparation room which is equipped with a hot cell that is generally operated by technologists under the control of the hospital pharmacy. This department is preparing the final doses from cold kits and generators, while only long half-life tracers and fluorinated tracers are delivered from central places. Such an infrastructure can without difficulty adapt to 68Ge/68Ga generators. However, when considering the current use of 68Ga, especially using synthesis automates, this local hospital radiopharmacy structure remains expensive as it requires a proportionally high number of dedicated experts (radiochemist, radiopharmacist…), local investment as well as local handling authorizations which are still only accessible for a limited number of the hospitals (<25% in Europe). The recent introduction of cold kits, allowing the production of 68Ga-tracers as easily as 99mTc, will definitely reduce the time of preparation and the overall cost for 68Ga-tracers. However, the presently high price of generators makes this local product interesting only if all doses of gallium can be used daily in patients.

In the US and a few rare other countries, the vast majority of customers rely on industrial centralized radiopharmacies. This structure is more pragmatic as it concentrates on central sites both investment and experts. In theory, those sites should show also a better profitability. These sites run several large 99mTc-generators from which they produce

individual tracer doses sometimes even as pre-filled syringes directly shipped to hospitals and clinics. They buy large amounts of other radionuclides from which they prepare final products also shipped to these customers. When 18F-FDG started playing an important role, these same centers became equipped with cyclotrons as their geographic distribution did fit well with the customer density. Additional centers were created to fill the distribution gaps. Four major players control the largest areas with their networks (Cardinal Health, PETNET, SOFIE and Jubilant-Draximage) which actually have now adapted their network to radionuclides with the half-life of fluorine-18 (108 min). These centers are located in the most populated areas and, if required, can ship doses at up to 6 hours distribution distance. Trying to adapt such a network to a radionuclide with a shorter half-life (68Ga has a half-life of only 68 min) will unfortunately limit accessibility to distant sites.

In other words, the existing US radiopharmacy network is not fully adapted to 68Ga due to its shorter half-life, while in Europe the market is not yet ready for buying ready-to-use tracers when such tracers can be prepared on-site from a generator with the existing staff and infrastructure.

Additionally, introducing a new 68Ga-tracer on any market will need to take in account new parameters:

- Very soon there will be new sources of 68Ge available, the parent isotope for gallium-68. This will increase competition among manufacturers and sooner or later directly impact down the price of generators. It will favor individual generator implementation, but providing that the final authorized product is based on cold kits, otherwise it will become too costly in terms of local marketing authorizations. First CoGs calculations have shown that single doses of 68Ga could reach levels that tend to be almost competitive with generator produced 99mTc, i.e., reducing the price of the PET modality to the price of SPECT modality.At the same time a new way to produce directly very large amounts of pure gallium-68 (more than 50 times the capacity of a generator) based on standard cyclotrons (the same cyclotrons as the ones used to produce fluorine-18) will become available. This will favor centralized production, but also have the double advantage of being independent of the decay of 68Ge which reduces over time the generator capacity, and being clean of 68Ge as potential contaminant. Depending upon the number of single doses that could be produced and distributed per batch, the price of cyclotron-produced 68Ga could even be competitive with generator produced 68Ga when the price of 68Ge will have dropped.

From the final customer side there should be no major changes or investment to be required. Providers will just have to guarantee a smooth supply of the new 68Ga-labeled tracers and generators or bulk 68Ga. Using 68Ga as PET tracers instead of 18F labeled tracer will not need new equipment. Software will have to be adapted to this tracer and new indication, which is actually the case for any new tracer brought on the market. All PET imaging centers presently equipped for handling fluorine-18 will be able to use the new 68Ga tracers. This means that the installed PET customer base will remain the same. There are an estimated 2,300 PET cameras installed in the US, actually largely underused equipment, that will easily cope with new tracers. This figure has to be compared with an estimated 930 PET cameras installed in the European Union countries (EU-28) and an estimated 6,400 PET cameras installed worldwide. Indeed, the density implementation of PET cameras is very high in the US, with a ratio of 65 PET cameras per 10 million inhabitants, compared to a ratio of only 18 PET cameras per 10 million inhabitants in the European Union. There is some small growth to expect in Europe in some smaller underequipped countries but in all countries only if new PET tracers for indications other than oncology (e.g., neurology or cardiology) become available for larger applications. The largest growth is presently only expected in not yet saturated areas such as Asian countries, including China, South American countries and Russia. Availability of 68Ga on the basis of generator will favor development in those countries.

For countries with a well-developed cyclotron installed base, such as the USA, it would make sense to use this equipment to partially supply customers with 68Ga through this channel. Almost any cyclotron able to produce 18F could in theory be able to produce 68Ga, providing some small investment. Like for cameras, the US market has already a large and underutilized installed base of cyclotrons: some 250 cyclotrons with energy below 25 MeV, so able to be used for producing gallium-68, are in operation in the US. The density vs. cameras is even higher in Europe (geographic) with 260 installed cyclotrons. Only daily capacity production will define profitability while new local regulation hurdles may slow down the implementation.

So far, no radiopharmacy company has taken a decision to invest in priority in one or the other technology, but such decision needs to be made soon. Both in Europe and in the US the structures will have to adapt. Eventually the owners of the new proprietary 68Ga- tracers will force their own way of access to market on the basis of the most cost-effective solution. The first cost of goods evaluations has shown that centralized cyclotron production could fit with both markets, but a time frame of about two years will be needed for full implementation.