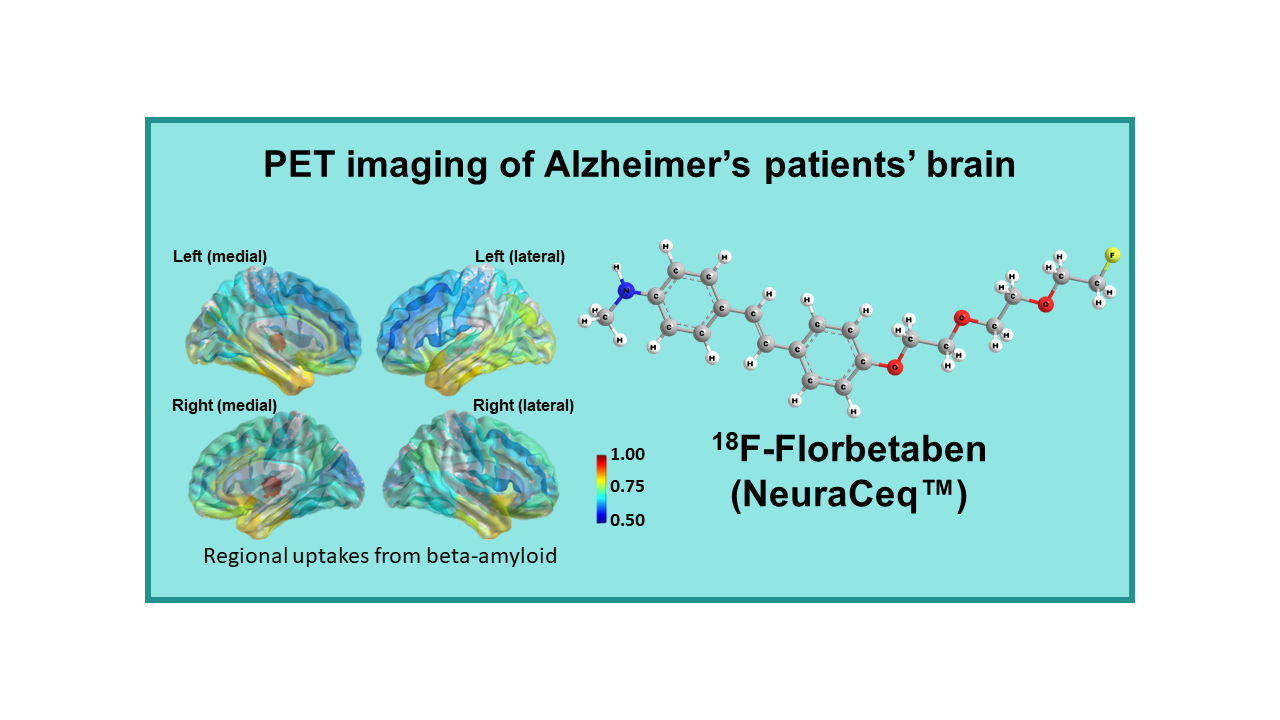

18F-Florbetaben (NeuraCeq™)

February 24, 2024

18F-Florbetaben, marketed under the brand name Neuraceq®, is a radiopharmaceutical used in positron emission tomography (PET) imaging for the detection of beta-amyloid plaques in the brain. Beta-amyloid plaques are a hallmark pathology associated with Alzheimer’s disease, a progressive neurodegenerative disorder that affects memory, cognition, and behavior.

The accumulation of beta-amyloid plaques in the brain is believed to be an early event in the pathogenesis of Alzheimer’s disease. 18F-Florbetaben PET imaging works by binding to beta-amyloid plaques in the brain, allowing for their visualization and quantification. This imaging technique can help clinicians in the diagnosis and management of Alzheimer’s disease and other causes of cognitive impairment.

Neuraceq® (18F-Florbetaben) has been approved by regulatory agencies for clinical use in various countries for imaging beta-amyloid plaques in the brain. It is considered safe and well-tolerated, with minimal side effects reported in patients undergoing imaging with this radiopharmaceutical.

18F-Florbetaben PET imaging with Neuraceq® provides valuable information for clinicians to differentiate between Alzheimer’s disease and other forms of dementia, track the progression of beta-amyloid deposition in the brain, and monitor treatment response. It plays a crucial role in early diagnosis, disease staging, and treatment monitoring, ultimately contributing to improved patient care and outcomes in individuals with cognitive impairment.

Overall, 18F-Florbetaben PET imaging with Neuraceq® is a valuable tool in the evaluation of patients with suspected Alzheimer’s disease and other neurodegenerative disorders. It offers important insights into the underlying pathology of the disease and helps guide clinical decision-making for optimal patient management.

Description

18F-Florbetaben (NeuraCeq™, Piramal Imaging trade name; earlier name was AV-1, when developed by Avid Radiopharmaceuticals; then BAY 94-9172, when developed by Bayer, or ZK-6013443; also 18F-FBB) is a fluorinated tracer developed by Avid Radiopharmaceuticals and acquired by Bayer Schering Pharma in July 2007. This tracer was the first 18F-labeled amyloid imaging agent tested in humans and was shown to interact specifically with amyloid plaques, whose accumulation in the brain is considered as a pathological hallmark of Alzheimer’s disease.

When purchasing AV-1, Schering did not use the option to acquire the entire pipeline of Avid Radiopharmaceutical and this company continued the development of the backup molecule 18F-AV-45 which became Florbetapir and eventually was acquired by Eli Lilly. The development of Florbetapir was shorter than the development of 18F-Florbetaben leading to its launch one year earlier, demonstrating that smaller companies have a better flexibility and less in-house administrative hurdles than larger ones. However, the 18F-Florbetaben clinical development program including 872 patients conducted in the US, Europe and Asia can be considered as a more rigorous and comprehensive program. NeuraCeq™ has received marketing authorization from the European Commission CHMP on February 24, 2014, from the FDA on March 19, 2014 and from the Korean Health authorities by June 2015.

Piramal Imaging, formerly Bayer-Schering Pharma, continued the collaboration with IBA Molecular (now SOFIE) and initially benefited from IBA Molecular’s radiopharmacy network. However, as IBA Molecular’s network does not provide full global coverage, Piramal needed to find other partners to manufacture and market their tracer. Since the acquisition of IBA Molecular NA by SOFIE, taken over from IHS (Zevacor), NeuraCeq manufacturing is now controlled by this company in the US. On November 21, 2013, Piramal Imaging entered into a strategic partnership with Ci-Co Healthcare, a South Korean company that is expected to help Piramal to obtain market authorization from the Korean Health Authorities and commercialize the tracer in South Korea. Ci-Co has assigned the manufacturing and supply of the agent to Duchembio, a radiopharmacy network in South Korea.

The Company Piramal Imaging was acquired by Alliance Medical in June 2018 and was renamed Life Molecular Imaging.

Clinical applications

18F-Florbetaben has initially been developed for PET imaging of Alzheimer’s patients’ brain. It is indicated for estimating beta-amyloid neuritic plaque density in adult patients with cognitive impairment who are being evaluated for causes of cognitive disorders. The approved indication in the US is limited to the exclusion of amyloid plaque accumulation, like for 18F-Florbetapir. A positive NeuraCeq scan does not establish a diagnosis of AD or other cognitive disorder and effectiveness of NeuraCeq has not been established yet for predicting development of dementia or monitoring responses to therapies.

Standard injected dose is 8 mCi per patient.

Recent studies (October 2016) have shown that 18F-Florbetaben PET imaging can also accurately identify and differentiate between cardiac amyloidosis and hypertensive heart disease. 18F-Florbetaben is used as tracer in the large IDEAS (US) and AMYPAD (Europe) clinical studies.

Availability

There was an agreement between Piramal Imaging and IBA Molecular to manufacture and distribute NeuraCeq through the PET manufacturing network of IBA Molecular in both the US and EU (transferred to IHS/Zevacor – now SOFIE – in the US following the acquisition of this company by this group). Sites producing regularly this tracer remain rare as its use remains also limited.

The USA 2020 average sale’s price of 18F-Florbetaben is US$ 3,300.

Competition

18F-Florbetaben, the second amyloid plaque imaging agent to reach the market, is in direct competition with two other molecules that reached the same market for the same indication at the same time, 18F-Florbetapir (Eli Lilly/Avid Radiopharmaceuticals, 2012) and 18F-Flutemetamol (GE Healthcare, 2014) as well as a newcomer that is still in phase II clinical development, Flutafuranol (Navidea, initially expected 2018, but apparently, development on hold). By February 2018, 18F-Florapronol (Alzavue® from FutureChem) obtained its marketing authorization in South Korea.

Actually, FDG has some applications for imaging neurodegenerative disease, but evaluation of brain images needs good expertise. However, FDG is not authorized for imaging of neurodegenerative diseases as large-scale clinical efficacy trials have never been performed. As FDG is a generic, there is limited chance that someone will invest in such an expensive trial.

The use of fluorinated tracers will be limited by the cost of the dose. These imaging tools will never be used for large population screening, even if one day approved for the diagnosis of AD. Research for in vitro (blood) tests is progressing and may be successful within the coming 2 to 3 years, i.e., before a therapeutic agent for AD could come on the market. So far, spinal fluid analysis has proven to be efficient as there is a possibility to identify biomarkers in this fluid (or more probably metabolites of amyloid molecules) that are directly related to the progression of the disease.

However, this method cannot be used as a routine procedure in patients and blood tests would be more appropriate. Researchers have great hope to succeed soon in finding and isolating these biomarkers in the blood. Such a test could become an easy diagnostic and/or prognostic test for AD. The use of fluorinated tracers could then be limited to the patients with a positive blood test, for confirmation of the diagnosis and evaluation of the disease extension. Actually, a general population screening would considerably increase the number of scans to be performed with the tracer and positively impact the overall business in imaging of AD.

The real applications of blood tests and imaging will see a drastic increase in interest when those tests will be linked to the prescription of a therapeutic agent. Knowing the number of therapeutic molecules under development and the attrition rate, such a molecule cannot be expected before 2020, but an optimistic target could be 2022. Note however, that therapy in AD will be efficient only if the treatment is put in place before clinical signs are seen in the patient and will be more efficient the earlier the patient can be treated. Such an evolution would need a general population screening which will be really expensive.

In April 2015, a four-year research study, with an estimated budget of US$100 million, was announced by the Alzheimer’s Association and the American College of Radiology (ACR). The Imaging Dementia – Evidence for Amyloid Scanning (IDEAS) Study will determine the clinical usefulness and value in diagnosing Alzheimer’s and other dementias in certain situations of a brain positron emission tomography (PET) scan that detects a core feature of Alzheimer’s disease. The purpose of the IDEAS Study is to examine how brain imaging, specifically an amyloid PET scan, helps guide doctors in diagnosing and treating Alzheimer’s and other dementias in cases where the cause of cognitive impairment is difficult to diagnose. Any PET tracer approved for imaging of amyloid plaque imaging can be used in this trial. This study was initiated in response to the 2013 CMS National Coverage Decision (NCD) on amyloid PET imaging in dementia and neurodegenerative disease not cover the scans because of insufficient evidence of efficacy of tracers. The study will involve more than 18,000 patients and inclusion really started in April 2016.

Comments

The decision of CMS agency to limit reimbursement of Amyvid to only one PET beta- amyloid scan to exclude Alzheimer’s disease will also affect Florbetaben. This decision obviously had a major impact on the market potential of the drug and disappointed not only the owners of the tracer, but also the developers of all competing tracers. In the short term it may impact all investment and development activities on other tracers.

Competition for this tracer can first be seen at the level of manufacturing centers which cannot and will not implement manufacturing of more than one of these tracers. If a geographic sector is covered by only one manufacturer, without competition for example from FDG, there will be no competition with a second amyloid tracer at this place as long as no one invests in a new manufacturing center. In places covered by several centers, competition may affect the dose price in the same way as if these products were generics.

Manufacturers will soon replace this product by new fluorinated compounds for which they will keep geographic exclusivity. The situation is definitely not easy for owners and manufacturers. If more than one molecule is made available at the same place, customers will have to decide which one they will use. In the absence of comparative studies, again the final dose price will decide, and the business model may be similar to the one for generics. Being the second tracer reaching the market for a same indication, it is interesting to follow the progression of the manufacturing and distribution of this tracer.The future of Amyvid will also depend upon the new strategy of the company for which major changes occurred recently.