18F-Flutemetamol (Vizamyl™)

February 24, 2024

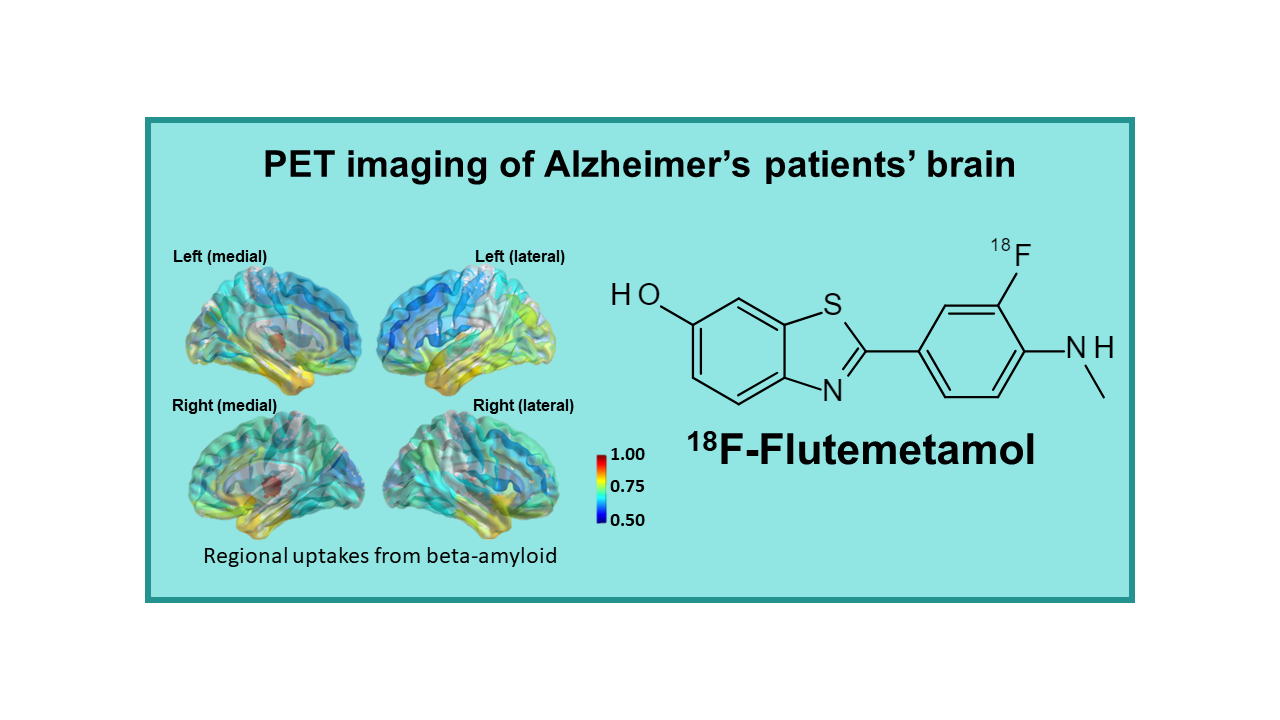

18F-Flutemetamol is a radioactive diagnostic agent used in positron emission tomography (PET) imaging of the brain to detect the presence of beta-amyloid plaques, which are a hallmark characteristic of Alzheimer’s disease. It is a fluorine-18-labeled derivative of the compound PiB (Pittsburgh compound B), which has been shown to bind specifically to beta-amyloid plaques in the brain.

18F-Flutemetamol was developed by GE Healthcare and received approval from the U.S. Food and Drug Administration (FDA) in 2013 for use in PET imaging of the brain to aid in the evaluation of patients with cognitive impairment who are being evaluated for Alzheimer’s disease and other causes of cognitive decline. It is administered intravenously and quickly crosses the blood-brain barrier to bind to beta-amyloid plaques, allowing for the visualization and quantification of amyloid deposition in the brain.

PET imaging with 18F-Flutemetamol can help clinicians differentiate between Alzheimer’s disease and other forms of dementia, as well as monitor disease progression and response to treatment. It is a valuable tool in the early and accurate diagnosis of Alzheimer’s disease, allowing for earlier intervention and management of the disease.

Description

18F-Flutemetamol (18F-AH110690, Vizamyl™) is a fluorinated tracer targeting amyloid plaques, developed by Amersham / GE Healthcare that is derived from the original tracer 11C-PIB, so far, the best tracer in this field that also remains one of the reference compounds. The addition of a fluorine atom in the chemical structure unfortunately slightly decreased the quality of the images, compared to 11C-PIB, but the product apparently reached the same level as its two first competitors, 18F-Florbetapir and 18F-Florbetaben. This tracer interacts specifically with amyloid plaques whose accumulation in the brain is potentially considered as a biomarker for evolution of neurodegenerative diseases.

18F-Flutemetamol was authorized by the FDA for the US market in October 2013 and by the EMA for the EU market in September 2014. It is available under the name Vizamyl™.

Clinical applications

18F-Flutemetamol has initially been developed for PET imaging of Alzheimer’s patients’ brains. It is indicated for estimating beta-amyloid neuritic plaque density in adult patients with cognitive impairment who are being evaluated for causes of cognitive disorders. The approved indication in the US is limited to the exclusion of amyloid plaque accumulation and as such can only be used as a pharmacological tool, but not a diagnostic agent. A positive Vizamyl scan does not establish a diagnosis of AD or other cognitive disorders and effectiveness of Vizamyl has not yet been established for predicting development of dementia or monitoring responses to therapies.

18F-Flutemetamol is structurally similar to 11C-PIB and the agent performs similarly to PIB with a sensitivity of 93% and a specificity of 96%. Standard injected dose is 5 mCi, the lowest among the four commercialized fluorinated amyloid imaging agents.

18F-Flutemetamol is one of the tracers used in the large IDEAS (US) and AMYPAD (Europe) clinical studies.

Availability

Vizamyl became available in the US market in 2014. As GE Healthcare does not have its own PET manufacturing network, the company has been in discussion with centers that will implement the technology, manufacture and distribute the tracer. In these discussions, GE Healthcare is of course in competition with both Eli Lilly and Piramal Imaging, the two competitor companies that also have a need to create their partner manufacturing networks in the US. The distribution of implemented sites, and hence the availability of Vizamyl, depends upon the freedom to operate and the level of GMP of the available sites distributed over the US. It will be interesting to watch how these three tracers will be supplied and how the individual dose prices will evolve, knowing that based on the limitations set by the FDA, the market will remain very limited during the first years. The same problem arose by end of 2014 in Europe when the company obtained its MA in this area.

The USA 2020 average sale’s price is US$ 4,000.

Competition

18F-Flutemetamol is the third amyloid plaque imaging agent to reach the market, after 18F-Florbetapir (Eli Lilly/Avid Radiopharmaceuticals, 2012) and 18F-Florbetaben (Piramal Imaging, 2014). A newcomer that is still in phase II clinical development Flutafuranol (Navidea) was expected to reach the same market by 2018, but seems to be on hold. By February 2018, 18F-Florapronol (Alzavue® from FutureChem) obtained its marketing authorization in South Korea.

Actually, FDG is also a good tracer for imaging neurodegenerative disease, although evaluation of brain images needs a lot of expertise. However, FDG is not authorized for imaging of neurodegenerative diseases as large-scale clinical efficacy trials have never been performed. As FDG is a generic, nobody will invest in such an expensive trial.

The use of fluorinated tracers will be limited by the cost of the dose. These imaging tools will never be used for large population screening, even if one day approved for the diagnosis of AD. Research for in vitro (blood) tests is progressing and may be successful within the coming 2 to 3 years, i.e., before a therapeutic agent for AD could come on the market. So far, spinal fluid analysis has proven to be efficient as there is a possibility to identify biomarkers in this fluid (or more probably metabolites of amyloid molecules) that are directly related to the progression of the disease. However, this method cannot be used as a routine procedure in patients and blood tests would be more relevant and less expensive. Researchers have great hope to soon succeed in finding and isolating these biomarkers in the blood. Such a test could become an easy diagnostic and/or prognostic test for AD. The use of fluorinated tracers could then be limited to the patients with a positive blood test, for confirmation of the diagnosis and evaluation of the disease extension. Actually, this would also lead to considerably increasing the number of scans to be performed with this tracer and positively impact the overall business of imaging in AD.

The real applications of blood tests and imaging will see a drastic increase in interest when they will be linked to the prescription of a therapeutic agent. Knowing the number of therapeutic molecules under development and the attrition rate, such a molecule cannot be expected before 2022-2024. Therapy in AD will be efficient only if the treatment is put in place before clinical signs are seen in the patient and will be more efficient the earlier the patient can be treated. Such an evolution would need a general population screening which will be really expensive.

In April 2015, a four-year research study, with an estimated budget of US$ 100 million, was announced by the Alzheimer’s Association and the American College of Radiology (ACR). The Imaging Dementia – Evidence for Amyloid Scanning (IDEAS) Study will determine the clinical usefulness and value in diagnosing Alzheimer’s and other dementias in certain situations of a brain positron emission tomography (PET) scan that detects a core feature of Alzheimer’s disease. The purpose of the IDEAS Study is to examine how brain imaging, specifically an amyloid PET scan, helps guide doctors in diagnosing and treating Alzheimer’s and other dementias in cases where the cause of cognitive impairment is difficult to diagnose. Any PET tracer approved for imaging of amyloid plaque imaging can be used in this trial. This study was initiated in response to the 2013 CMS National Coverage Decision (NCD) on amyloid PET imaging in dementia and neurodegenerative disease not cover the scans because of insufficient evidence of

efficacy of tracers. The study will involve more than 18,000 patients and inclusion was really started in April 2016.

A similar study called AMYPAD was initiated one year later in Europe. AMYPAD is a consortium created in collaboration with IMI project EPAD (the European Prevention of Alzheimer’s Disease project) and aims to determine the value of ß-amyloid imaging as a diagnostic and therapeutic marker for Alzheimer’s disease. AMYPAD officially started on October 1, 2016 and has a duration of five years. The project involves 15 academic and private research partners. AMYPAD will scan a large population cohort (n=900) suspected of possible Alzheimer’s disease, focusing on those with subjective cognitive decline (SCD), mild cognitive impairment (MCI) and atypical/unexplained dementia, to determine the usefulness of ß-amyloid imaging regarding diagnostic confidence, decision trees, change in diagnosis, and patient management plans. The primary objective is to measure the impact on patient management of early versus late utilization of amyloid PET imaging.

Comments

The decision of CMS agency to limit reimbursement of Amyvid to only one PET beta- amyloid scan to exclude Alzheimer’s disease will also affect 18F-Flutemetamol. This decision obviously had a major impact on the market potential of the drug and disappointed not only the owners of the tracer, but also the developers of all competing tracers. In the short term it may impact all investment and development activities on other tracers.

Competition for this tracer can first be seen at the level of manufacturing centers which cannot and will not implement manufacturing of more than one of these tracers. If an area is covered by only one manufacturer, without competition from for example FDG, there will be no competition with a second amyloid tracer at this place as long as no one invests in a new manufacturing center. In places covered by several centers, competition may affect the dose price in the same way as if these products were generics. Manufacturers will soon replace this product by new fluorinated compounds for which they will keep geographic exclusivity. The situation is definitely not easy for owners and manufacturers. If more than one molecule is made available at the same place, customers will have to decide which one they will use. In the absence of comparative studies, again the final dose price will decide.

As the third molecule on the market, it will be interesting to follow the progression of the manufacturing and distribution of this tracer and to understand how the company will find partners to work with and at which site they will be able to implement the tracer manufacturing unit. GE Healthcare does not have its own network of PET manufacturing centers but can rely on the sites at which their FDG technology SteriPET (under license) has been implemented. SteriPET is presently manufactured in at least 12 facilities in total in Finland, Great Britain, Italy, the Netherlands, Norway, Portugal, Sweden, Spain and Turkey.