90Y-Ibritumomab Tiuxetan (Zevalin®)

March 23, 2024

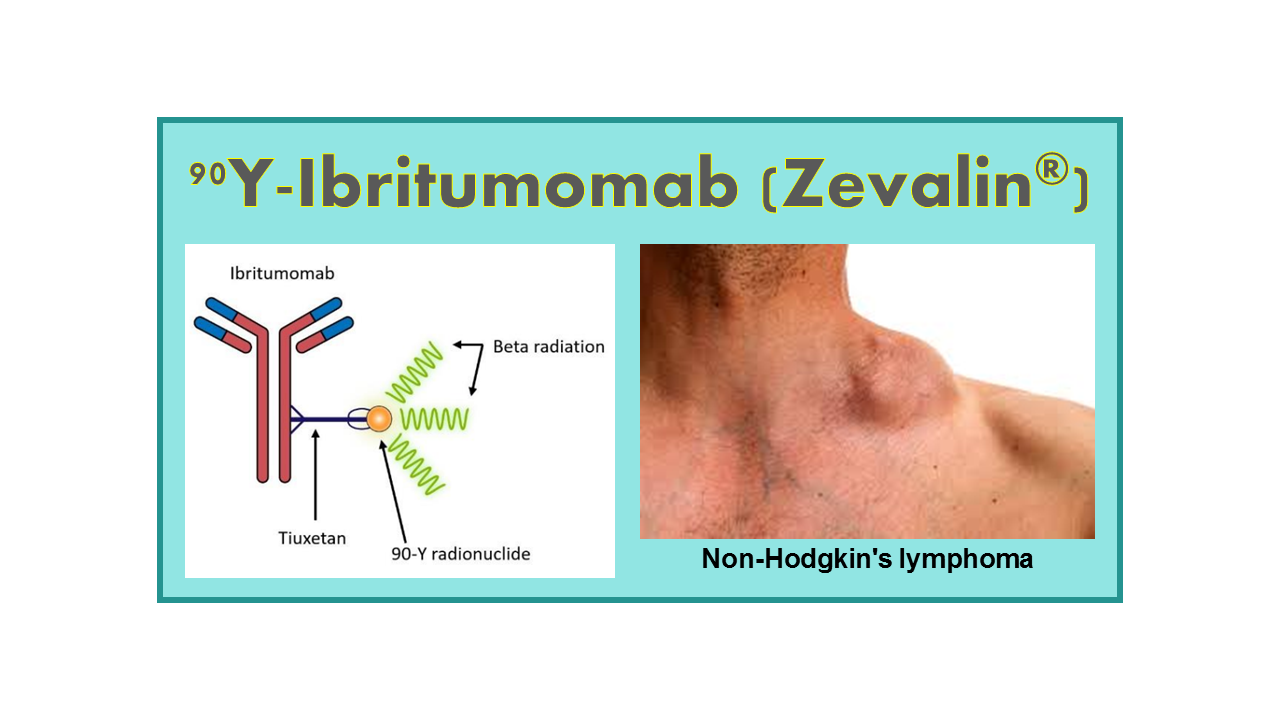

90Y-Ibritumomab Tiuxetan (Zevalin®) is a radiopharmaceutical used in the treatment of certain types of non-Hodgkin’s lymphoma. It consists of two main components: the monoclonal antibody ibritumomab and the radioactive isotope yttrium-90 (90Y).

Ibritumomab is a monoclonal antibody that specifically targets a protein called CD20, which is found on the surface of B cells. By binding to CD20, ibritumomab delivers the radioactive isotope 90Y directly to the cancer cells, allowing for targeted radiation therapy.

The radioactive isotope 90Y emits beta radiation, which can penetrate tissues and target cancer cells while minimizing damage to surrounding healthy tissues. This targeted radiation therapy helps to destroy cancer cells and shrink tumors.

Zevalin® is typically used in patients with certain types of non-Hodgkin’s lymphoma, such as follicular lymphoma and transformed follicular lymphoma. It is administered as an intravenous infusion and is usually given after other treatments have been tried without success.

Overall, 90Y-Ibritumomab Tiuxetan (Zevalin®) offers a targeted approach to treating non-Hodgkin’s lymphoma by delivering radiation directly to cancer cells, potentially improving treatment outcomes while minimizing side effects.

Description

90Y-Ibritumomab tiuxetan (90Y-Zevalin, BAY86-5128, IDEC-129, IDEC-Y2B8, SH-L-749, Zevamab) is an IgG1 kappa-monoclonal murine antibody directed against the CD20 antigen radiolabeled with Yttrium-90 and developed by Idec Pharmaceuticals (which later became Biogen Idec). It was the first radioimmunotherapy drug approved by the FDA in February 2002 to treat cancer, under the name Zevalin®. EU approval was obtained in January 2004, following the approval in March 2003 of the first 90Y solution (from a 90Sr/90Y generator) needed for the labeling.

Rights were acquired in 2007 by Cell Therapeutics Inc. (for the US) and Bayer Schering Pharma (outside of US). In March 2009, Spectrum Pharmaceuticals acquired 100% control of RIT Oncology, LLC, the joint venture created with CTI, and became responsible for all activities relating to the drug in the US. In January 2012, Spectrum Pharmaceuticals acquired all licensing rights from Bayer (Schering). Details are to be found under http://www.zevalin.com/ .

111In-Ibritumomab tiuxetan (IDEC-In2B8) was developed by IDEC as the imaging agent able to select the potential positive responders to Zevalin. The imaging step (5 mCi dose) was mandatory as a consequence of the absence of imaging potential for 90Y. Over time IDEC (and Spectrum) could demonstrate that for the targeted population this first imaging step was not useful (a higher rate of complete response has been noted in patients with negative 111In-Ibritumomab diagnostic scans) and by 2011 the company obtained the authorization to skip this imaging step before treatment.

In January 2019, the US company Acrotech Biopharma acquired the rights for Zevalin from Spectrum Pharmaceuticals. In May 2020, the company CASI Pharmaceuticals announced the plan to initiate the registration trial for Non-Hodgkin’s lymphoma with Zevalin in China in early 2021.

Clinical applications

Zevalin is indicated for the following indications:

- Treatment of relapsed or refractory, low-grade or follicular B-cell non-Hodgkin’s lymphoma (NHL).

- Treatment of previously untreated follicular NHL in patients who achieve a partial or complete response to first-line chemotherapy (expanded label obtained in September 2009).

The market for this product is actually limited by its very strict label. Spectrum Pharma was conducting several phase III trials to expand the indication:

- The ZEST study in patients suffering from diffuse large B-cell lymphoma (DLBCL). Study was terminated.

- The SPINOZA trial in patients suffering from relapsed DLBCL who have received autologous stem cell transplantation (ASCT). Study was withdrawn.

- A comparative study with Rituxan in previously untreated patients with follicular NHL.

RIT with Zevalin achieved 65 to 80% overall response rate and more than 20% complete response in relapse or refractory NHL patients.

90Y-Ibritumomab tiuxetan’s standard treatment is given at 0.4 mCi/kg (average 30 mCi). The agent is dosed by patient body weight and baseline platelet count unlike the competitor Bexxar in which the doses were determined by patient-specific dosimetry.

Because 90Y is a pure beta emitter, the radiation risk to the patient’s family and others is minimal, making it possible to treat patients on an outpatient basis.

Availability

Zevalin is a proprietary drug sold so far by Spectrum Pharmaceuticals and some distributors having obtained the license (Fuji Film in Japan). Acrotech Biopharma is taking over since beginning of 2019 and CASI Pharmaceuticals detains the rights for greater China.

Zevalin was initially sold at a price around US$ 22,000–24,000 (EUR 20,000-22,000) in the US and around EUR 20,000 (US$ 22,000) in the EU for the treatment delivered over 7–9 days. Patients are pre-treated with Rituxan (not included in the price). Overall, this treatment remains cheaper than any other NHL chemotherapy treatment (usual range EUR 40,000-60,000 – US$ 44,000-66,000).

In 2020 in the USA, a dose of Zevalin is now charged around US$ 62,000, while the 111In- Ibritumomab tiuxetan diagnostic dose is charged around US$ 4,000.

Competition

The analogue 131I-Tositumomab (Bexxar) came on the market at the same time (2004) and, in the US, the two products were in competition for the same indication. In summer 2013, GSK announced that Bexxar will be withdrawn from the market which effectively took place by February 2014 as a consequence of poor results, leaving the space open for Zevalin.

Zevalin patents expired around 2018. Analogues such as 177Lu-Ibritumomab tiuxetan are covered by the Zevalin patent but only protected until the end of 2013 in the EU and mid- 2015 in the US. 177Lu-Rituximab (177Lu analogue of 131I-Bexxar) apparently is to be considered as a generic product already.

The major competition will come from the chemotherapy area, although less efficient in the addressed indication, because Rituxan will also become a generic product starting in 2014. This will translate into a drug price war, with the risk that the price of the drug will have priority over the efficacy. In The same indication Nordic Nanovector is now developing two new drugs of interest 177Lu-Betalutin and 177Lu-Humalutin that could take over the market of Zevalin or jeopardize market shares if Acrotech pushes the drug again.

Comments

Zevalin was the first radiolabeled antibody approved for cancer treatment. For the same indication it was very soon under competition with 131I-Bexxar. Despite large acceptance by the nuclear medicine community, this product did not reach the success it deserved.

In fact, the sales results of any drug are directly linked to the budget assigned to the marketing campaign. Neither Zevalin, nor Bexxar, were launched and supported under the same conditions that any other chemotherapeutic is promoted. In the absence of a much larger marketing budget and a strategy targeting oncologists instead of nuclear physicians, it should not be a surprise that sales figures remained far below EUR 100 million (US$ 110 million) despite superiority over chemotherapies.

The marketing of this product was conducted in the same way as other radiopharmaceuticals were supported. The target population was also limited to nuclear physicians and oncologists never got incentives to prescribe this drug. A careful observation of the sales evolution of the recently launched Xofigo by a conventional pharmaceutical company used to this standard marketing procedure tells us that a product with the profile of Zevalin could also become the next blockbuster.

In summary, Zevalin fell short of expectations for a variety of reasons, including oncology referral incentives, drug administration challenges, confusion over appropriate patient populations, cost and complexity of manufacturing, and supply challenges.

Actually, it is not too late, as if Zevalin is approved as a first-line treatment, also in the absence of a serious competitor such as Bexxar withdrawn from the market and Rituxan that became generic, this could be the best opportunity to restart large-scale promotion of Zevalin with the target to transform it into a blockbuster. Unfortunately, this will need investments in the range of several tens of millions of euros.