99mTc-Sestamibi

January 9, 2025

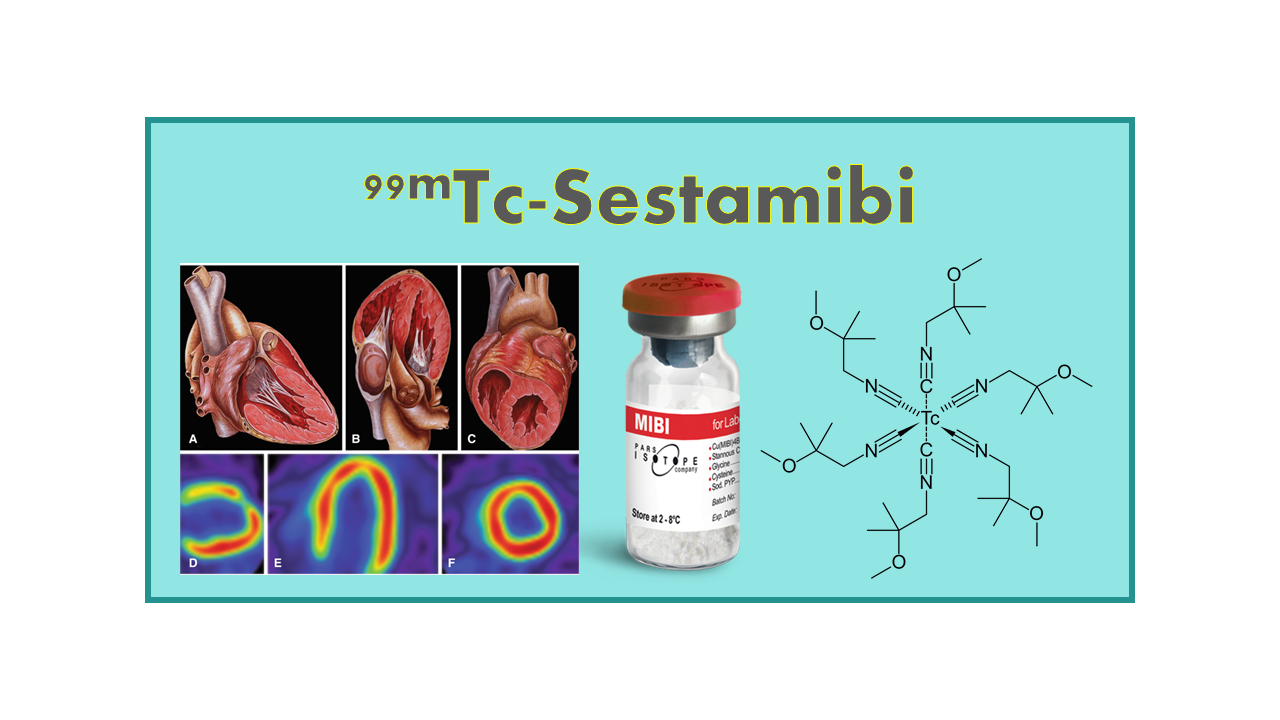

99mTc-Sestamibi is a radiopharmaceutical agent used in single-photon emission computed tomography (SPECT) imaging for the evaluation of myocardial perfusion. It is a lipophilic cationic complex that selectively accumulates in mitochondria-rich cells, such as cardiac myocytes, allowing for the visualization of myocardial blood flow and viability.

The agent is injected intravenously and rapidly taken up by the myocardium, where it becomes trapped due to its lipophilic properties. This allows for the visualization of areas of reduced blood flow or perfusion, which can indicate areas of ischemia or infarction.

99mTc-Sestamibi has become a widely used imaging agent in the assessment of patients with suspected coronary artery disease or myocardial infarction. It provides valuable information about the extent and severity of myocardial ischemia, as well as the viability of the myocardium.

Overall, 99mTc-Sestamibi is a valuable tool in the non-invasive evaluation of myocardial perfusion and can help guide treatment decisions in patients with cardiovascular disease.

Description

99mTc-Sestamibi is the generic name of the 99mTc-labeled Tetrakis-(2-methoxyisobutyl isonitrile) copper(I) tetrafluoroborate [Cu(MIBI)4BF4] originally sold under the brand name Cardiolite (myocardial perfusion) or Miraluma (breast cancer imaging). Some licensees have rebranded the compound in their respective distribution countries, for example: IBA Molecular – Curium (CardioCIS), Lamepro (Cardiolite) (see below).

Often nuclear physicians simply call this tracer mibi (for methoxyisobutylisonitrile) and it is also referred to in the literature as 99mTc-MIBI. This product was the first large-scale SPECT imaging agent for myocardial perfusion. This tracer was developed and launched by DuPont Pharmaceuticals (subsequently acquired by Bristol-Myers Squibb Co). BMS sold its medical imaging business to Avista Capital Partners, forming Lantheus Medical Imaging Inc. Sestamibi is now in the public domain.

Clinical applications

99mTc-Sestamibi is the most common myocardial perfusion agent that is indicated for:

- Detecting coronary artery disease by localizing myocardial ischemia (reversible defects) and infarction (non-reversible defects)

- Evaluating myocardial function

- Developing information for use in patient management decisions

99mTc-Sestamibi can also be used, following mammography, as a second-line diagnostic aid to assist in the evaluation of breast lesions in patients with an abnormal mammogram or a palpable breast mass. For this application the tracer was sold under the trade name Miraluma. 99mTc-Sestamibi cannot be used as a substitute for mammography for the first- line diagnosis of breast cancer.

Attempts to extend the applications to other indications such as medullary thyroid cancer imaging, non-Hodgkin’s lymphoma and glioma were not pursued.

Availability and price

In the US Sestamibi is available from Cardinal Health, Mallinckrodt (Curium), Draximage, and Lantheus Medical Imaging. DiaMed launched the drug on the Russian market under the name Technetril™ (Russian MA obtained in 1994).

Generic Sestamibi is available from AAA (MIBI AAA), BRIT (TCK-50), Cardinal Health (MA obtained in 2009), Cyclopharma (Mibitec®), Draximage (US NDA obtained in 2009; Sestamibi or Draxmibi®), Fuji Film (Cardiolite Daiichi), IBA Molecular (Curium) (Stamicis®), IDB/AAA (Draximage license with Draxmibi), Mallinckrodt (Curium) (Technescan Sestamibi®), Medi-Radiopharma (Medi-MIBI and Cardio-SPECT), NIFHI Russia (Technetril), Pars Isotope (MIBI), Pharmalucence (MA obtained in 2009), ROTOP (CardioTOP®, Cardiomibi®, Mibispect®, Cardiovis®), POLATOM (PoltechMIBI, CardioTOP, Cardiovis, Cardiomibi, Mibispect), SAM Nordic (Sammibi) and Wuxi Jiangyuan.

The brand Miraluma from Bristol Myers Squibb was withdrawn from the US market.

Doses are patient weight dependent and the price per patient of a cold kit cost about EUR 40–110 (US$ 44–120), down from above US$ 400+ since generics are available. The dose per patient ranges from 10 to 20 mCi. In 2020 in the USA, a dose of Sestamibi is charged around US$ 120.

Lantheus Cardiolite (brand product) sales were in the range of US$ 400 million a year during the years 2004-2007 but then started to drop in 2008 to now reach less than US$ 10 million. This clearly demonstrates the influence of the introduction of generics at the time the Lantheus patents did expire. Lantheus anticipated this decline and developed a PET analogue (18F-Flurpiridaz) which is still completing Phase III trial and definitely will not replace the SPECT tracers.

Competition

Dupont obtained the MA for 99mTc-Sestamibi in December 1990 both in the EU and the US. A few years after its launch, Sestamibi came in competition with GE Healthcare’s 99mTc-Tetrofosmin (Myoview – US MA obtained in 1996). Several other attempts to develop competitors came, some up to phase III clinical stage, but were discontinued mainly because they could not show superiority over the two existing marketed tracers (Q12/Mallinckrodt, CISNoet/CISbio-Schering Pharma). Cardiotec (99mTc-Teboroxime, Bracco), the third marketed tracer (since 1990) was withdrawn in 2004, leaving Cardiolite and Myoview sharing the market with MPI. Both tracers are however, in the public domain and are facing strong competition from generics.

In myocardial perfusion imaging, European cardiologists have a preference for 201Tl-Thallium Chloride. The limited use of 201Tl in the US is more due to a limited source of this radionuclide than to the superiority of 99mTc. However, it seems that there are more advantages in using 99mTc-Sestamibi. 201Tl-Thallium Chloride came up again as an alternative only when the shortage of 99Mo became a limiting factor in using 99mTc-labeled tracers.

Advantages of 99mTc-Sestamibi over 201Tl-Thallium Chloride can be seen in terms of physical half-life (shorter for 99mTc permitting the use of a higher dose for higher quality images), of ideal gamma energy of 99mTc (140 keV without beta, on the contrary to 201Tl) and the availability from a generator.

99mTc-Sestamibi is a SPECT agent and is now facing potential competition with PET tracers. Unfortunately, 18F-labeled compounds will never be able to compete with 99mTc in terms of price and this was probably one of the reasons why Lantheus decided to discontinue the development of 18F-Flurpiridaz (note that the Flurpiridaz program was restarted in 2017 with the help of GEH). 15O-water, 13N-ammonia and 82Rb-Chloride have all shown superiority over SPECT agents, but these three tracers are not readily available. Even if the production of 82Sr/82Rb generators were to develop in the near future, the share of the market for this PET agent will remain enough small that it will not impact the sales and the use of Mibi. The real competition for this market is now between generic manufacturers and this resulted in a price competition only.

Comments

99mTc-Sestamibi has proven its superiority over the years above all other SPECT agents (may be with the exception of 99mTc-Tetrofosmin), and will remain the cheapest solution when compared to PET imaging agents (with the exception of 82Rb which however, will need very high investment before taking a larger share of the Mibi market).Cardiologists are also very satisfied with the 99mTc myocardial imaging agents, and, on the contrary to oncologists, do not really need new tools for their diagnostics. Of course, there are some specific applications for which cardiologists would be glad to have access to new tracers, but these applications are niche areas of limited interest for developers. In the cardiovascular diagnostic and imaging area the next big market potential stays with the detection of vulnerable plaque.