177Lu-Oxodotreotide

December 27, 2024

Description

177Lu-Oxodotreotide (also known as 177Lu-Lutathera®, 177Lu-DOTATATE, and Lutetium-177 dotatate) is a somatostatin analogue developed for the treatment of neuroendocrine tumors (NETs). It was the first 177Lu-labeled molecule to receive marketing authorization. The drug was originally developed by Biosynthema, which was acquired by Advanced Accelerator Applications (AAA) in 2010.

The drug was approved in Europe in 2017 for the treatment of unresectable or metastatic, progressive, well-differentiated, somatostatin receptor-positive gastroenteropancreatic neuroendocrine tumors (GEP-NETs) in adults. In 2018, it was approved by the FDA in the USA for the treatment of somatostatin receptor-positive GEP-NETs, including foregut, midgut, and hindgut tumors in adults. AAA held exclusive rights to DOTATATE for therapeutic use before being acquired by Novartis. AAA licensed relevant patented technology from Mallinckrodt, whose patents expired in 2016 in Europe. The drug has also received Orphan Drug designation in both the US and Europe.

Before the drug obtained its marketing authorization (MA), DOTATATE was provided through ABX and Bachem under clinical trials for diagnostic use with 68Ga. The somatostatin peptide analogue is produced by several European companies, including ABX, piCHEM, Bachem, JPT, IBD, and Biomedica. It is also available from FutureChem.

Clinical evaluation of this radiolabeled drug began over 15 years ago at Erasmus MC in Rotterdam, Netherlands. Additional clinical investigations have been conducted in Sweden, Italy, Australia, Germany, and Switzerland. Lutathera® became available on a named-patient basis in various European countries, and in the US, the Excel Diagnostics Nuclear Oncology Center in Houston, Texas, was the first North American facility authorized to treat patients with 177Lu-DOTATATE. Several US research groups, including BioSynthema Inc., Missouri University Research Reactor (MURR), and IsoTherapeutics Group, have also been involved in its development.

By January 2018, Novartis completed the acquisition of AAA and its product 177Lu-Lutathera. Though Novartis now controls the molecule, other companies can develop parallel copies since it is a generic molecule. Since 2017, FUJIFILM has been conducting a Phase I/II trial with 177Lu-oxodotreotide in Japan, while several German hospitals continue providing 177Lu-DOTATATE on a named-patient basis with on-site preparation.

Non-carrier-added 177Lu-labeled oxodotreotide

In 2020, Point Biopharma acquired the rights to a 177Lu-labeled molecule developed by CanProbe (University Health Network and Centre for Probe and Commercialization) in Canada. This compound, named 177Lu-PNT2003, is a non-carrier-added (nca) 177Lu-labeled form of DOTATATE, currently completing Phase III trials. The drug is expected to be filed for approval by 2021, with indications for non-GEP-NETs and new GEP indications. Its introduction may not directly compete with Lutathera initially, but market competition is expected by the end of 2022.

Clinical applications

177Lu-DOTATATE was developed for treating patients with GEP-NETs. Phase II results from Erasmus MC in Rotterdam showed significantly longer progression-free survival (45.1 months) compared to Sandostatin® LAR® (14.6 months). The kidney is the critical organ that must be protected during therapy through amino acid injections. Over 3,000 patients were treated with this drug before Phase III trials began.

The FDA expanded access to Lutathera® in the US to include patients with progressive, advanced, and inoperable NETs at all sites. While further clinical exploration is needed, 177Lu-Lutathera has shown promise for GEP-NETs and other potential indications.

Additional development

177Lu-DOTATATE was the first radiolabeled somatostatin analogue to enter Phase III clinical development. The NETTER-1 trial, which compared treatment with 177Lu-DOTATATE to Octreotide LAR® in patients with inoperable, progressive midgut carcinoid tumors, enrolled 230 patients and was completed in 2015. The trial demonstrated positive data, leading to the drug’s approval in Europe and the US.

In July 2017, AAA received a positive opinion from the CHMP recommending approval of Lutathera® for GEP-NETs in Europe. The first Japanese patient was treated with the drug in a Phase I study in September 2017. Since receiving MA, over 25 clinical studies involving 177Lu-DOTATATE have been initiated, with more than 3,000 patients expected to be recruited. These studies are exploring the drug’s advantage in combination therapies with other treatments such as avelumab, capecitabine, and pembrolizumab.

Beyond NETs, 177Lu-Oxodotreotide is being investigated for non-NET indications, including medullary thyroid cancer, carcinoid heart disease, metastatic Merkel cell carcinoma, meningioma, pheochromocytoma, ganglioma, neuroblastoma, and small cell lung cancer (SCLC).

The nca 177Lu-labeled analogue, 177Lu-PNT2003, is nearing the completion of a Phase III trial involving almost 200 patients. The NDA for this drug is expected to be filed by the end of 2021.

Availability and prices

Before obtaining MA, the drug was available for compassionate use at a cost of US$68,600 for a full treatment (four injections). By 2018, the US list price was set at US$47,500 per dose, with the full treatment costing US$190,000. In Europe, prices were lower and discussed on a country-by-country basis. Generic versions of the drug are available in some countries, such as India, and produced locally in certain hospital radiopharmacies.

By 2021, Novartis announced that 384 hospitals were using 177Lu-Lutathera.

In 2020, the Iranian company Pars Isotopes launched a generic version of 177Lu-DOTATATE, and the introduction of 177Lu-PNT2003 by 2022 may initiate price competition.

Sales

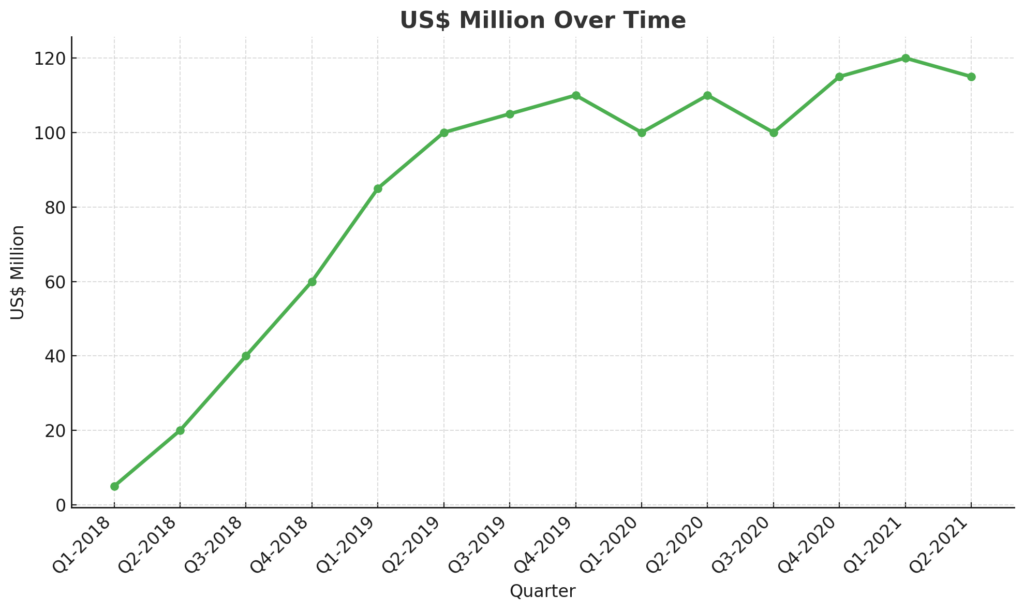

The sales of 177Lu-Lutathera have grown since its launch, though the figures for 2020 and 2021 were impacted by the COVID-19 pandemic. Despite competition, Novartis expects annual revenue for the drug to exceed US$480 million by the end of 2021. However, Novartis faces challenges in Europe due to competition from local hospital centers that produce their own generic formulations of 177Lu-DOTATATE.

The figures for the second quarter of 2020 and the first half of 2021 reflect the impact of COVID-19 on routine operations in nuclear medicine departments. While data for Q3 and Q4 of 2021 were unavailable at the time of publication, based on the trend and the ongoing effects of the pandemic, it is projected that this product could achieve over US$ 480 million in revenue for the entire year of 2021.

The figures from 2019 to 2021 shown above represent Novartis’ sales for the product, which were slightly below expectations due to a plateau effect. This can be attributed to incomplete reimbursement negotiations with European authorities, delaying the launch of actual sales in Europe during these years. Furthermore, Novartis faces significant competition in Germany, the largest European market, where established centers continue using their own formulations. Since 177Lu-DOTATATE is a generic product, and as long as these centers do not sell doses outside their hospitals, displacing this market remains challenging. Therefore, the global market for 177Lu-DOTATATE is much larger than the figures reported by Novartis for 177Lu-Lutathera alone. The slowdown observed from Q2 2020 to Q2 2021 is largely due to the COVID-19 lockdown period. Moving forward, Novartis will face increasing competition from analogues labeled with nca 177Lu, particularly Point Biopharma’s 177Lu-PNT2003, which is expected to enter the market in 2022.

Comments

The development of Lutathera® faced delays, partly due to its passage through various academic and underfunded entities. However, since receiving market authorization, the drug has shown strong potential. With a price tag of US$190,000 per treatment, sales could potentially reach US$3 billion if fewer than 20,000 patients are treated. AAA claims that generic versions of Lutathera® will not enter the market for some time due to Orphan Drug exclusivity. Nevertheless, competition is expected, particularly with 177Lu-PNT2003 and other similar compounds.

Lutathera® may also face issues with the quality of 177Lu, particularly in countries where higher patient volumes could strain production capacity. However, such challenges would arise only if the drug experiences significant growth in sales.