82Rb-Rubidium Chloride

March 23, 2024

82Rb-Rubidium Chloride is a radiotracer used in positron emission tomography (PET) imaging for the evaluation of myocardial perfusion. It is produced by a generator system that extracts the 82Sr isotope and allows it to decay into 82Rb, which is then used to label rubidium chloride for injection.

Once injected into the patient’s bloodstream, 82Rb-Rubidium Chloride behaves like natural rubidium and is taken up by myocardial cells in proportion to blood flow. By emitting positrons, 82Rb can be detected by the PET scanner, allowing for the visualization and quantification of myocardial blood flow and perfusion.

The short half-life of 82Rb (approximately 75 seconds) allows for rapid imaging protocols, making it suitable for dynamic PET studies. This rapid decay also limits the radiation exposure to the patient and medical staff.

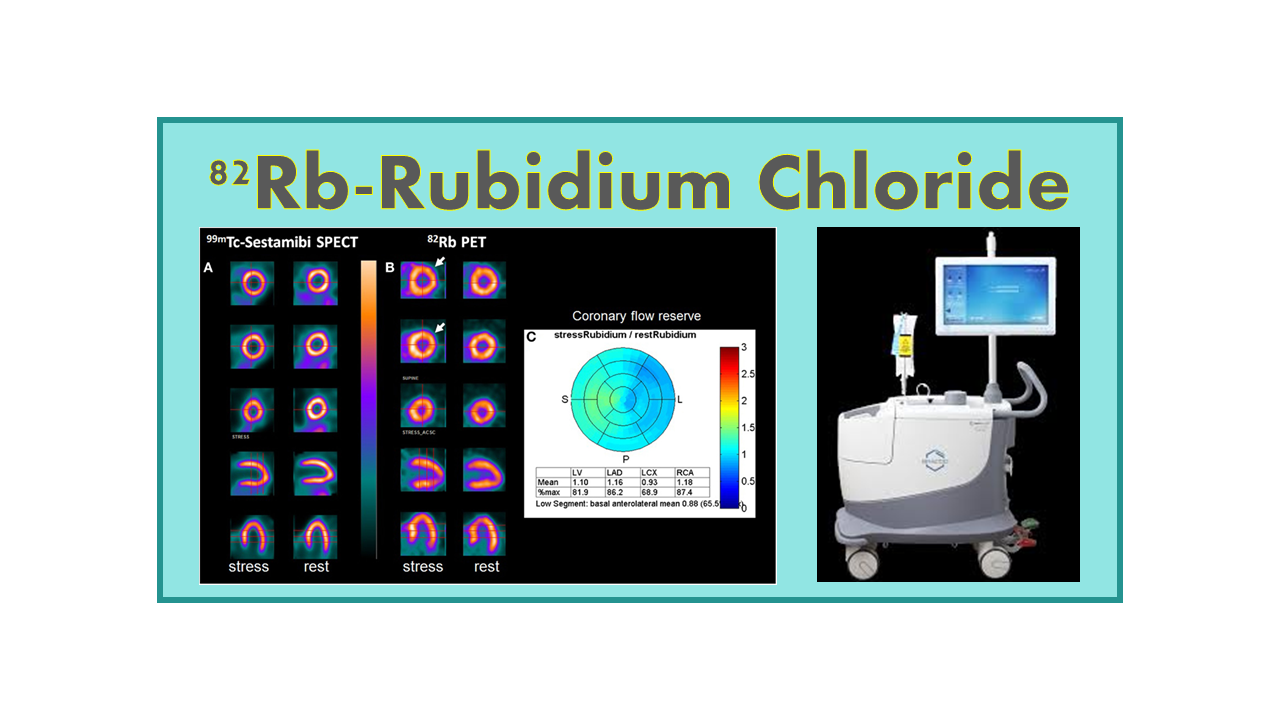

The high spatial resolution of PET imaging combined with the physiological information provided by 82Rb-Rubidium Chloride allows for the accurate assessment of myocardial perfusion defects, aiding in the diagnosis and management of coronary artery disease and other cardiac conditions.

Overall, 82Rb-Rubidium Chloride is a valuable tool in cardiac imaging, providing essential information for the evaluation of myocardial perfusion and contributing to improved patient care in cardiology.

Description

82Rb-Rubidium Chloride is a very short half-life tracer used for cardiac PET imaging. It can only be obtained through a generator. Bracco Diagnostic was in a monopoly situation for a long time with this product. Bracco sells the generator since 1982 (and only in the US) under the name CardioGen™. First marketing authorization was obtained in 1989. AAA does have the license for distribution in Europe, but the product has not reached this market yet. Between 2011 and 2013, Bracco had to face an FDA product withdrawal, but the situation came back to normal since 2016. In October 2020, the US FDA cleared Bracco’s new CardioGen-82 infusion system.

Jubilant Draximage filed an NDA for a new generator called Ruby-Fill™ and the MA was granted from the FDA in October 2016. Commercialization was launched in the US by end of the same year. Ruby-Fill generator was also approved in Canada, but the elution system was approved only by end of September 2017. In June 2019, Jubilant DraxImage received the CE Mark for its Ruby rubidium elution system and proprietary consumable accessories for the Ruby-Fill 82Rb generator.

Clinical applications

82Rb-Rubidium Chloride is a PET imaging agent used in myocardial perfusion imaging. The product behaves like potassium and is rapidly taken up by heart muscle cells. Abnormal heart uptake is easily identified allowing diagnosis of ischemia and necrosis. 82Rb almost has the profile of an ideal flow tracer: it has a short half-life for repeat rest and stress Myocardial Perfusion Imaging with negligible waiting time, a linear extraction rate over a wide range of flow, independent of metabolism, and it delivers low radiation to patients and staff. 82Rb behaves like the more conventional SPECT agent (201Tl and 99mTc imaging agents) with the advantages of higher quality images, fast procedure (less than 30 min compared to 4 hours) and the possibility to quantify. 82Rb also shows some significant advantages in obese patients and in women. In terms of imaging quality, it is surpassed only by 15O-Water and 13N-Ammonia.

Generators are typically supplied with 50 to 100 mCi of 82Sr. This enables regular elution of 30–60 mCi (a patient dose) of 82Rb over the useful life of the generator (4 weeks). Elution can take place every 10-15min, so without real limitation in terms of number of patients. However, the dilution over the 4 weeks leads to a lower quality of images during the 4th week, limiting imaging to non-obese patients.

A study presented at the American College of Cardiology meeting in March 2018 clearly demonstrated superiority of PET with 82Rb-Rubidium Chloride over SPECT 99mTc-Sestamibi in detecting severe obstructive coronary artery disease (CAD), enabling more appropriate use of revascularization treatment. This advantage is mainly explained by higher-quality images, quantification of myocardial blood flow, and shorter scan times.

So far, the cardiac indication is the only one for which this product has received a marketing authorization, but around 2013, a new use has been discovered in imaging tumors, in particular for the follow -up of angiogenesis. The mechanism and utility need to be explored (conclusion pending). A clinical study in prostate cancer has been initiated by end of 2016. Consequently, a publication released in 2019, showed that 82Rb PET/CT may have potential as a non-invasive tool for evaluation of tumor aggressiveness and monitoring in nonmetastatic prostate cancer. Further evaluation is needed.

Competition

For a long time, this technology was only available in the US (and for research purpose in other countries) and sold under a marketing authorization obtained by Bracco in 1989. As a consequence of the shortage of both 99Mo and 82Sr, that mainly affected cardiology procedures, several companies became interested in competing with Bracco.

Bracco was in a monopoly situation since 1982, but in 2013, Draximage filed a first dossier for their new 82Sr/82Rb generator under the name Rubi-Fill. The market authorization in the US was obtained by end of 2016. This company started by facing a limitation in access to the precursor 82Sr. In the meantime, some private companies did work on projects to enter this potentially rewarding business (Zevacor, CDNM), and several others considered investments in the manufacturing tools (AAA, Arizona Isotopes). In the meantime, also some new sources of 82Sr became available, but as these centers (Arronax – France, INR – Russia) are mainly research centers their capacity will continue to remain limited. The first private productions entirely dedicated to the production of large amounts of 82Sr became available in the US by 2018 (Zevacor – now Curium) and the Russian solution (CDNM) is under construction and should be ready by 2021. Development of new generators will take more time.

The French 82Sr/82Rb generator project associated to Arronax is developed under the name Quanticardi by the French company Naogen. Market authorization is now expected by 2022 as Naogen does not need to perform a clinical trial: as being a generic, the EU dossier for the generator can be based on literature data obtained with the two other marketed generators. Naogen is still looking for funds to prepare the GMP production sites and to launch the generator in Europe.

On March 27, 2018, Bracco Diagnostics filed a complaint against Jubilant DraxImage and two of its affiliates for alleged patent infringement regarding rubidium-based radiopharmaceuticals for cardiac PET studies. In October 2019, a judge issued a final initial determination in which he found no violation by Jubilant DraxImage of unfair competitive practices and no unfair acts involving the exportation and sale of its generators in the U.S.

Availability

Bracco’s generator is sold on the basis of a yearly contract of 13 generators exchanged every 28 days for a listed (non-negotiated) price of US$ 420,000 (EUR 323,000) (about US$ 35,000 / EUR 27,000 per generator). The new marketing authorization that Bracco obtained increased the shelf-life from 28 to 42 days. Actually, this longer shelf-life only guarantees a higher quality for the product compared to the original 28 days shelf-life, as the amount of 82Rb produced beyond 4 weeks becomes too small for cardiology centers that have a high daily patient throughput. This increase of shelf-life at least guarantees a longer use period without risk of 82Sr breakthrough, which was the reason of the shutdown period.

Based on these figures, the cost per patient is estimated at around EUR 140-180 – US$160-200 (based on ten patients per day). Next to the generator, the customer needs an automatic injector (provided by Bracco or Jubilant). For each patient there will also be an investment of consumables of about EUR 13 (US$ 14).

In 2015 in the US the dose of injected 82Rb-Rubidium was reimbursed US$ 250 while the full imaging modality (without the tracer) was reimbursed US$ 1,286 (to be compared to the reimbursement of US$ 1,139 for a full 99mTc-sestamibi procedure and two times US$ 70 for the tracer). In 2020 in the USA, a dose of 82Rb is charged around US$ 520.

Figures provided by Medicare show that the number of PET MPI procedures performed (or at least reimbursed) in 2014 (which were mainly 82Rb procedures as 13N-ammonia was not reimbursed at that time) amounted to 100,619 scans. If one considers that only 170 generators were in operation during that year, each cardiology office scanned in average 590 patients per year (or less than 3 patients per working day). Despite this low number and the loss of opportunity, it seems that the PET MPI business still remains highly profitable as the average income per center was US$ 148,000 (590xUS$ 250) for the product and US$ 758,000 (590xUS$ 1,286) for the full procedure. Obviously private cardiologists charge more than the Medicare reimbursement rate to their patients (up to three times).

Bracco and Jubilant-Draximage are not anymore limited by the availability of 82Sr, and with the introduction of both the Zevacor/curium and Arizona Isotope production capacities, there is a kind of guarantee for long term sustainability. So, new yearly contracts can be signed. There are presently about 250 US customers with yearly contracts. This figure has to be compared to the figure of 31,000+ cardiologists that are active in the US and potentially interested as well. Any new customer interested in 82Rb will had to wait either until a former customer drops out or for additional sources of 82Sr, which is not the case anymore. The Zevacor/Curium, the Arizona Isotope and the CDNM 70 MeV production centers could add up to 400 customers each.

AAA was officially the distributor of the generator of Cardiogen in Europe, but in absence of 82Sr, the centers that presently have access to this generator are the few that are participating in the clinical trial that is supposed to allow Cardiogen to obtain a MA for Europe. Cardiogen was granted MA to AAA but only in Switzerland during Q1, 2013. AAA failed to obtain market authorization for this generator in Europe.

The advantage of the Naogen generator over the older devices is its capacity to retain 82Sr. The Bracco generator can be eluated with a maximum of 15 liters of eluant while the Naogen generator has not shown breakthrough of 82Sr after eluting with 35 liters of liquid. This new generator is expected to reach the EU market by 2022.

By end of April 2019, radiation events prompted FDA notice on 82Rb-generators. User substituted erroneously the saline solution for generator elution with a calcium containing solution, leading to the extraction of the strontium from the generator column. FDA requested safety labeling modifications and user training for both Bracco and Draximage generators and customers.

Comments

Bracco was the company with the monopoly on this technology for years. By 2011, when the shortage of 99Mo and indirectly for 99mTc became a major issue at the same time, and Bracco had to face a FDA product withdrawal, several companies became interested in alternative imaging modalities for cardiology, among which a new 82Sr/82Rb generator. The newcomers had to both find an alternative source of 82Sr and develop a system for producing and injecting 82Rb. On top of this the increasing interest in this modality outside of US, triggered the interest of investors worldwide. Several projects have been started following the first productions of the 82Sr with the 70 MeV Arronax cyclotron in Nantes. With the help of the Loire Valley Region and the French government, Arronax started the project QuantiCardi. Several private initiatives with some first investments in larger equipment followed. The new serious sources of 82Sr include:

- The Zevacor/Curium cyclotron operational since summer 2017.The Russian CDNM project with the Kurchatov Institute which was supposed to be operational during 2017, but finally took some delays due to delays in the building and will be implemented only by 2020. First production is expected by end of 2021.The company Arizona Isotopes Corp which acquired in 2018 a 70 MeV cyclotron IBA that will entirely be dedicated to the production of 82Sr. The site is under construction in Indianapolis IN, USA, and is expected to be operational by 2021. The company expects to acquire a second cyclotron with even right of first refusal for machines three and fourThe Italian INFN project with the implementation of a 70 MeV Best cyclotron which was supposed to become operational in the course of 2017, but has delays as wellNTP in South Africa has acquired a 70 MeV in 2019 and will among other radionuclides also produce 82SrAnother 70 MeV was acquired in South Korea, but it seems the aim will be limited to research purpose

The Positron Corp. project also based on a 70 MeV cyclotron based in the US, must be considered as on hold. In fact, all existing accelerators with sufficient energy have at some time considered becoming manufacturers of 82Sr but so far have not pursued this opportunity.

If all projects described above come to reality, there would still, in theory, not be enough production capacity. This is mainly because the competition will make the generator price more affordable for a larger customer population. It is estimated that for the US alone a network of five 70 MeV accelerators manufacturing at high-capacity would be needed to cover the potential market by 2022-2025. The pace of introduction of new generators on the market is mainly driven by the investments of cardiologists in PET cameras, i.e., the decision to switch from SPECT to PET at an individual level, which remains a several year process.

82Rb cardiology imaging has proven to be of higher quality than SPECT, and with similar potential to 15O or 13N. Its extension is simply limited by the generator price, but private clinics have found interesting ways to make this business more profitable by increasing the patient throughput. A generator with an associated dedicated cardio camera can allow the screening of two to three patients an hour. This model is presently only valid in the US due to the development of private cardiology centers authorized to handle radioactive substances and cannot be transferred to Europe where almost all cardiology equipment is public funded. However, due to the higher imaging quality of 82Rb, major centers will get the investment for equipment and generators before 2020 in Europe. In other words, it is very realistic to consider a potential market of at least 50 customers in Europe by 2020, but not several hundreds.

Eventually, one has to consider the introduction on the market of the first fluorinated PET cardiac agent, 18F-Flurpiridaz, which resumed development and is presently completing Phase III trial. The introduction of this PET tracer will be more complicated as several PET manufacturing centers will need to be adapted, but this tracer will bring at least an alternative solution to cardiologists, which may consider less risky to switch from SPECT to PET technology. Indirectly this will also contribute to increasing the potential market for cardiac PET. The largest financial risk remains with the owners of 18F-Flurpiridaz.