Iodine-131 (131I)

January 17, 2024

Properties:

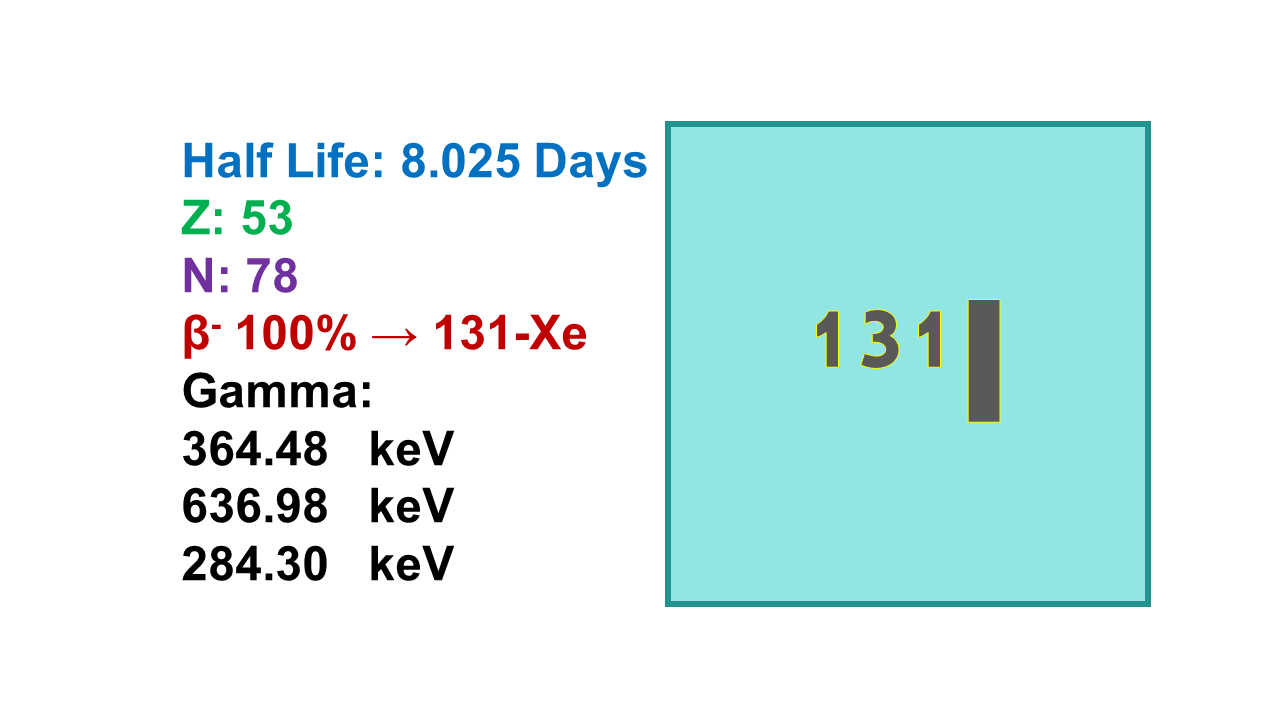

Iodine-131 (131I) is both a gamma and a beta emitter with a half-life of 8.02 days. The 131I gamma emission (364 keV; 81%) can be used for documentation of the biodistribution of the agent and to calculate a patient-specific dosage to deliver the desired therapeutic radiation dose. The mean path-length of the beta particle emitted at 606 keV (90%) is 0.4 to 0.9 mm. Tenth value layer (TVL) is 10 cm for concrete and 7.6 mm for lead. Maximum specific activity of 131I is 124 Ci/mg.

Manufacturing:

131I can be produced by two different routes. Either it is obtained by direct neutron irradiation of pure Tellurium-130 transformed into 131Te, followed by a decay into 131I, [130Te(n,γ)131Te]→131I or by the purification of the fission process mixture of Uranium-235 [235U(n,f)131Te]→131I. The second route is preferred because the same purification process also leads to 99Mo and 133Xe. The fission route produces 131I batches at the several hundreds of Ci level. However, the number of sites extracting 131I from the irradiation mixture is very limited and in the US for example all 131I is imported. MURR is presently developing the capability to supply 131I. Some potential domestic 99Mo suppliers also have plans to supply 131I and/or 133Xe in the future.

The specific activity of the fission route 131I remains low (about 20%), which means this is not a nca radionuclide, but the purity is sufficient for labeling of complex molecules such as antibodies and the contamination with other iodine isotopes is mainly due to 127I (stable isotope) and 129I (half-life 15.7 million years).

Source and availability:

The production of radiopharmaceutical-grade 131I is a very well-established industrial process. Hundreds of curies’ amounts of 131I are usually produced in the same batch as 99Mo. In theory all large reactors producing 99Mo should be able to produce 131I. In reality two processing centers provide the majority of the North American and European needs: 75% of pharmaceutical-grade 131I is produced from IRE (Belgium) and 25% from NTP (South Africa). The product is also listed in POLATOM’s (Maria reactor) and ANSTO‘s (OPAL reactor) catalogues. Until end of 2018, the USA lacked capacity to produce 131I and had to import this radionuclide (for a long time via Nordion/BWXT, Canada). On November 8, 2018 MURR announced its first shipment based on a domestic supply.

Smaller centers (China, Iran, Russia) can supply their domestic demand. Shortage of 131I has never been an issue despite the link with the 99Mo manufacturing process. However, more and more customers are now looking for a higher grade of 131I (i.e., the nca 131I produced via the tellurium route) and the number of sites producing this quality of radionuclide is very limited. The nca 131I was available from Nordion in the past, but this production was stopped. Today apparently, only ANSTO is producing nca 131I and it can be purchased via local providers which obtain it from ANSTO as well.

Derivatives:

131I was one of the first radionuclides used in therapy (in the 1940s for thyroid cancer treatment). 131I has a favorable chemistry which allows covalent bonding with organic molecules (i.e., without the need for a large chelating group that traps the radionuclide on the contrary to metals). Although the carbon-iodine bond is weaker than the carbon-fluorine bond, numerous molecules labeled with 131I have been developed and tested in humans.

131I still remains of interest for therapy (thyroid), but applications in radiolabeled products will decline as 177Lu and perhaps 67Cu in the distant future have better therapeutic profiles. 131I-labeled marketed products include of course 131I sodium iodide (capsules for thyroid cancer imaging and therapy), but also 131I-Adosterol, 131I-chTNT (Cotara® under development, but already marketed in China under the name Vivatuxin®), 131I-Human serum albumin, 131I-Iodohippurate, 131I-MIBG, 131I-Norcholesterol and 131I-Tositumomab (Bexxar®). GlaxoSmithKline’ 131I-Bexxar® was withdrawn from the market by end of 2014.

131I-labeled products under development include 131I-3F8, 131I-81C6, 131I-TLX101, 131I- BA52, 131I-Apamistamab/131I-BC8 (Iomab-B), 131I-CLR , 131I-TM601, 131I-Radretumab (131I-L19-SIP) and 131I-Trastuzumab. Marketing of 131I-Lipiodol and 131I-Fatty acids has been discontinued in Europe, but 131I-Lipiodol was relaunched in 2018 in India.

In November 2016, the company International Isotope Inc (I3) filed an ANDA for a new formulation of 131I-Sodium Iodide under the name Iodine/MAXTM. This product is based on nca 131I.

The therapeutic doses used in patients depend on the indication and can be comprised between 30 and 200 mCi. Diagnostic doses are lower. The US market is estimated to need between 40 and 50 Ci 131I per year for therapeutic use and below 5 Ci for diagnostic applications. The use of 131I in the US is following a decrease. This is probably linked to the revised guidelines of The American Thyroid Association (ATA) for the management of these diseases. Those include a recommendation to not treat with 131I patients who are at very low risk of cancer recurrence after surgery, and to reduce doses for patients who are at low risk of recurrence. It is anticipated that the decline in sale will continue until ATA recommendations will be fully adopted.

Price:

131I belongs to the less expensive radionuclide categories as a consequence of the huge batches produced weekly around the world. Also, prices of radionuclides produced by reactors cannot be compared with prices of privately produced radionuclides. There is no true competition on this market and radionuclide prices do not integrate infrastructure costs (reactor). 131I is sold in the range of EUR 100/Ci (US$ 130/Ci) for bulk amounts when large amounts are ordered. nca 131I is much more expensive.

On the contrary, the handling and labeling of 131I is expensive because of the requirement of double filtration systems and the decontamination costs, a consequence of the volatility of the element (valid for all iodine radioisotopes).

Very recently, list prices of 131I became available for China (CIRC) with figures reaching RMB 3,300 (US$ 490 / EUR 420) per Ci in 2017 and US$ 550 / EUR 470 per Ci in 2018.

Issues:

- 131I (like all iodine radioisotopes) suffers from the high volatility of this halogen, obliging high investments in radioprotection and radio-monitoring equipment.

- Applications of radioactive iodine-labeled molecules also require saturation of the patient’s thyroid before treatment (except for thyroid treatment of course).

Comments:

As a consequence of the above-described manufacturing and application constraints, and despite the very low manufacturing costs, industry becomes more and more reluctant to produce new 131I-iodinated compounds on a larger scale. In fact, industry has become reluctant in investing in iodine radioisotopes in general. This first led to the switch to 90Y derivatives and more recently to 177Lu derivatives.

The withdrawal of Bexxar from the market in 2014 will also change the future market potential of 131I. 131I will probably remain as a radionuclide only used for thyroid cancer therapy, unless some new approaches show superiority of 131I over 177Lu in some specific applications (e.g., for drugs that need to cross the blood–brain barrier (BBB) such as 131I- TLX101, or for certain specific drugs such as the ones developed by Precirix (ex-Camel- IDS) which demonstrated better efficacy with 131I than with 177Lu).