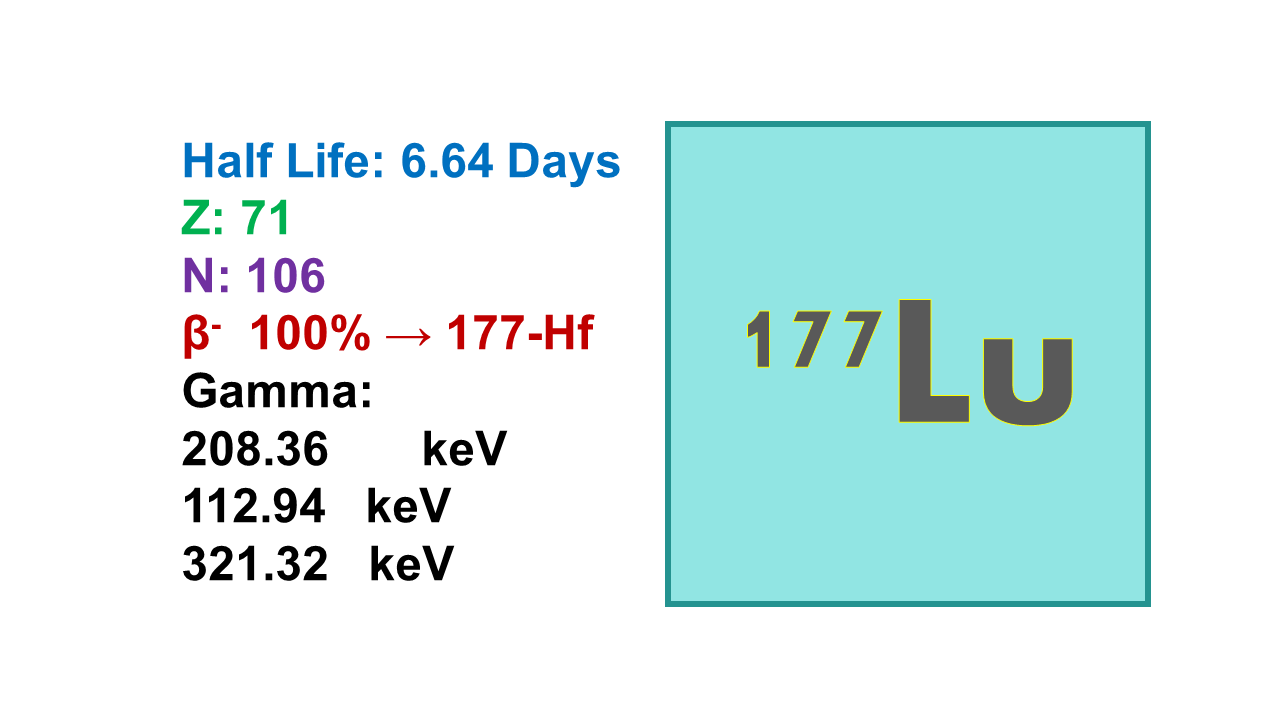

Lutetium-177 (177Lu)

February 26, 2024

Lutetium-177 is a radioactive isotope of lutetium, a rare earth metal. It is used in targeted radionuclide therapy for the treatment of certain types of cancer, particularly neuroendocrine tumors. Lutetium-177 has a half-life of about 6.7 days, which makes it ideal for medical applications as it decays relatively quickly while still providing a therapeutic effect.

Lutetium-177 is typically produced by irradiating natural lutetium targets with neutrons in a nuclear reactor. Once produced, it can be combined with a targeting molecule that binds specifically to cancer cells, allowing for precise delivery of radiation to the tumor while minimizing damage to surrounding healthy tissue.

The use of lutetium-177 in targeted radionuclide therapy has shown promising results in clinical trials, with many patients experiencing significant tumor shrinkage and improved quality of life. Research is ongoing to further optimize the use of lutetium-177 in cancer treatment and explore its potential for other medical applications.

Properties:

Lutetium-177 (177Lu), half-life 6.73d, is a β– emitter at 498keV (78.6%) and 177 keV (12.2%) decaying into stable Hafnium-177. 177Lu shows a major advantage in also emitting gamma rays at 208 keV (11.0%) and 113 keV (6.3%) which allows imaging with this therapeutic radionuclide. 100 mCi of 177Lu (max therapeutic dose) corresponds to approximately 1 µg of lutetium. The mean path length is 0.7 mm. Maximum specific activity of 177Lu is 109 Ci/mg. Tenth value layer (TVL) is 2.1 mm and half value layer (HVL) is 0.6 mm for lead (photons). HVL for betas is 1.35 mm for Plexiglas. Unshielded activity of 7,400 MBq (200 mCi, typical activity for 177Lu-DOTATATE) produces 56.5 µSv/hr.

Manufacturing:

177Lu is a reactor-produced radionuclide that can be obtained via two different routes, one based on irradiation of natural Lutetium-176 [natLu or 176Lu(n,γ)177Lu], the direct route, the other on Ytterbium-176 [176Yb(n,γ)177Yb→177Lu], the indirect route (half-life of the intermediate 177Yb: 1.9h). The two different routes result in two different qualities of lutetium. The indirect route provides high specific activity 177Lu (also called nca – no carrier added) which will allow the manufacturing of higher quality and even no carrier added radiolabeled drugs. The direct route does not allow separation of 177Lu from 176Lu and the use of this radionuclide can have some limitations (e.g., antibody labeling). The importance of the specific activity for labeling will be a criterion of selection, although a) the specific activity of the direct route 177Lu remains quite high (above 20% of theoretical) and b) the remaining 176Yb in the indirect route can also interfere with the labeling of molecules.

Natural Lutetium is a mixture of 175Lu (97.41%) and 176Lu (2.59%) in which 175Lu is a stable isotope while 176Lu is a long half-life unstable i.e., ‘almost stable’ isotope (half-life 3.78×1010 years). In order to improve yields, it is better to work with enriched Lutetium-176 and usually, the quality is around 80-90% enrichment.

On top of this, the carrier-added 177Lu also contains a long half-life impurity 177mLu, a by- product generated by the irradiation of the 177Lu that is produced during the process. 177mLu cannot be separated from the final product. This impurity has a half-life of 160.4d. The current direct production route delivers 177Lu with 177Lu/177mLu activity ratio ranging from 4,000 to 10,000. A method of separation of 177Lu from 177mLu (177mLu/177Lu generator) has recently been proposed (2019), without reaching for now the 177mLu breakthrough ratio. It is still a process more complicated compared to the direct production route.

Nusano (formerly Alpha Source, Inc) is proposing an alternative route based on [176Yb(d,n)177Lu] which could lead with a single accelerator to thousands of Ci/y nca 177Lu at 30 MeV and 4.0 mA, and even tens of thousands Ci/y at 50 MeV. This tool however, still needs to be built.

Sources and availability:

The number of sites presently producing 177Lu is not large, but these sites are able to cover the demand. In fact, a high number of sites (reactors) are able to produce 177Lu and countries such as India, China or even Russia (Dimitrovgrad) do have access to their own source. The centers that are now producing direct route 177Lu will easily be able to adapt to the indirect route and there is no real shortage issue with either 176Lu or 176Yb as long as requested amounts remain low.

Carrier-added 177Lu is available from BRIT (LU-2), Eczacıbaşı-Monrol (Lutec), JSC Isotope (small amounts, not yet GMP grade, for preclinical use only), Perkin Elmer, IDB/AAA (Lumark™) and POLATOM (LutaPol™ – capacity about 500 Ci/y).

In April 2015, IDB Radiopharmacy BV obtained a marketing authorization from the EMA for its ca 177Lu solution for radiolabeling (radiopharmaceutical preparation) under the name LuMark™. Capacity, i.e., maximum handling authorization of this site is around 50 Ci daily. IDB was acquired by AAA in 2016 and LuMark is now produced by AAA which itself went under the control of Novartis in 2018. In March 2017, AAA signed also a strategic supply agreement with MURR for the supply of 177Lu in the US.

Polatom has also registered its ca 177Lu solution (LutaPol – but their MA is valid only in Poland), while Monrol’s 177Lu became available as well by mid of 2019 (ca 177Lu – Lutec).

For nca177Lu, the company ITM became the major player and secured manufacturing and availability of large-scale nca 177Lu through own production and collaboration agreements with (or license transfer to) ANSTO (Australia) – authorization to produce was obtained in September 2015; first doses sold in November 2015 – and NTP (South Africa). No carrier added 177Lu is also available directly from ITM which irradiates targets at different reactor sites including FRM and BR2. In August 2016, the Committee for Medicinal Products for Human Use (CHMP) of the EMA granted the MA to nca 177Lu from ITG/ITM under the brand name EndolucinBeta®. ITM’s own production is based on target irradiation performed at the BR2 reactor (SCK CEN) or at FRM (Germany). In 2014, nca 177Lu became also available in very small amounts from Perkin Elmer (initial production source was MURR, but MURR stopped production of nca 177Lu). The company Global Morpho Pharma SAS is also proposing GMP grade nca 177Lu and developing a new technology for its production.

Small amounts of (not yet GMP grade) nca 177Lu can be obtained from JSC Isotope (maximum 80 Ci/y with a target to produce up to 200 Ci/y).

Since end of 2019, Isotopia (Israel) is also able to provide, next to ca 177Lu, small amounts of nca 177Lu based on their own production process. In September 2020, the company announced the signature of an agreement for production by CPDC in Canada of nca 177Lu for the NA territory, based on Isotopia technology. EZAG started production of nca 177Lu in March 2020. MURR filed and obtained its DMF for nca 177Lu by end of 2019. A few years ago, some companies considered using nuclear power plant to become the tool for irradiation of targets. In fact, it seemed interesting to use the reactor cavity of measurement of neutron flux in the center of the reactor as a place for introducing a target to be irradiated. Taking in account the neutron flux (a minimum of 1013 n/cm²-sec is required), EPR, KONVOI and CANDU reactors could be adapted for that purpose. In July 2018, ITM entered in an agreement with the Canadian Bruce Power LP to evaluate the possibility of implementing a 177Lu production unit at their Bruce nuclear power point

(CANDU reactors, 2×760 MW, 2×750 MW and 4×817 MW). ITM would be in charge of development, treatment of irradiated targets and international sales of 177Lu. Bruce reactors are already used for the production of 60Co. Target technology is developed by Orano. Bruce Power is since 2017 also developing the production of 99Mo. In October 2019, the feasibility study has been successfully completed (neutron flux at Bruce Power CANDU reactor is estimated at 2×1014 n/cm²-sec). Irradiation equipment for the production of nca 177Lu is expected to be installed at Bruce Power’s manufacturing facilities by late 2021. In November 2019, it was announced that French nuclear reactor firm Framatome, German radiopharmaceutical group ITM, Toronto-based Kinectrics, and Bruce Power of Tiverton, Ontario, will collaborate to create the framework for nca 177Lu production and distribution in a partnership that will last through 2064. In February 2020, the group created of a joint venture called Isogen. Isogen signed a MoU to advance feasibility work for the production of 99Mo. In June 2021, Framatome created a new unit, Framatome Healthcare, which will develop access to new medical radionuclides, amoung which 177Lu. Ontario Power Generation (OPG) has already started in June 2018 exploring the production of 99Mo at their center of Darlington (and hence could produce 177Lu) while the Swiss nuclear power plant of Gösgen-Däniken has started the same evaluation.

In May 2018, SHINE entered in a process license agreement with IOCB Prague Czech Republic with the aim to produce in the near future nca 177Lu on the basis of a new technology. The successful production of patient doses with this new technology was announced by SHINE in January 2020. SHINE sold the first dose of nca 177Lu in November 2020. Production capacity of the unit was announced at 300,000 doses per year.

The target material to produce nca 177Lu, namely 176Yb, is presently available only from a few sources that have limited capacities. 176Yb is not a rare isotope. There are about 50 tons of ytterbium produced each year and reserves are estimated at one million tons. Natural Ytterbium is a mixture of 12.7% 176Yb, 31.8% 174Yb, 16.12% of 173Yb, 21.9% 172Yb, 14.3% 171Yb, 3.05% 170Yb and 0.13% 168Yb. However, the separation of 176Yb from the other ytterbium isotopes is quite cumbersome, but, if needed, capacity of the largest center could be increased.

The largest source is FSUE Elektrokhimpribor in Russia which can produce about 700 g per year. The Kurchatov Institute in Moscow can produce about a tenth of this amount, while the US Canadian Calutron has a very limited capacity. The present price of 176Yb is varying between US$ 14,000/g and 18,000/g, but this price may rise within the next years and drop again when all manufacturers of 177Lu will have constituted their stocks.

In October 2019, Isotopia signed a contract with Elektrokhimpribor for supply of about 1,000 g (value US$ 17 M) of 176Yb over a period of 5 years. This press release confirms also the agreement with Novartis to acquire about 10 kg until 2028 for a value of US$ 180 M). FSUE Elektrokhimpribor is now working on increasing production capacity. There has not been yet announcement of the building of large production capacity units outside of Russia. As long as this monopoly situation exists, prices will not move.

Derivatives:

In therapy 177Lu becomes the new beta emitter option next to 90Y and 131I, with a different energy range that is more favorable for mid-size tumors. The dosimetry to healthy cells is also considerably reduced with 177Lu. In most of the 177Lu-labeled drugs under development, better efficacy has been demonstrated every time it was possible to perform comparison with 90Y-labeled analogues.

There is now officially one 177Lu-labeled drug on the market (177Lu-Lutathera, since end of 2017 in Europe and beginning of 2018 in the US) while 177Lu-EDTMP is also available but only in Iran. The next molecule that should obtain a MA is probably 177Lu-PSMA-617 (Novartis), by end of 2021.

The 177Lu-labeled drugs under development are listed in the following table. Several other 177Lu-labeled drugs are under preclinical development, and are described in Part 3 of this report. From knowledge of present trends, probably all molecules listed in the following table will be labeled with nca 177Lu.

LUTETIUM-LABELED MOLECULES UNDER CLINICAL DEVELOPMENT

| Target/Mechanism | D | Molecule | Company | Issues – Comments | ||||||||

| Avidin -Biotin complex Radiosurgery | 2 | 177Lu-ST2210 90Y-IART | Sigma-Tau (since February 2017 renamed Leadiant Biosciences Inc.) | Development program resumed in June 2017 using 177Lu instead of 90Y Breast cancer – on hold again since 2019 | ||||||||

| APC Alkylphosphocholin e | 3 | 177Lu-NM600 | University of Wisconsin- Madison | Preclinical Colon cancer | ||||||||

| Bisphosphonate | 2 | 177Lu-ZDA | ITM/NECSA | Early clinical stage Bone pain palliation Prostate cancer | ||||||||

| Bombesin receptor GRPR | 3 | 177Lu-NeoB (177Lu-NeoBomb1) | Novartis/AAA UMC Erasmus (NL) | Preclinical stage Prostate – Breast – GIST | ||||||||

| Bombesin receptor GRPR | 3 | 177Lu-ProBOMB1 | University of British Columbia | Preclinical 177Lu-NeoB has already shown superiority | ||||||||

| Bombesin receptor GRPR | – | 177Lu-AMTG 177Lu-AMTG2 | Technical University of Munich | Preclinical – Phase 0 | ||||||||

| Bombesin receptor GRPR | 2 | 177Lu-RM2 | Generic | Reactivated in 2019 | ||||||||

| Bone seeking agent | 2 | 177Lu-DOTAZOL | University of Mainz ITM | Phase I Bone pain palliation Prostate cancer | ||||||||

| CAIX | 2 | 177Lu-TLX250 Girentuximab (Lutarex) cG250 | Telix Pharma | Therapeutic agent Phase I/II Kidney cancer | ||||||||

| CCKR2 | 3 | 177Lu-DOTA-MGS5 | University of Innsbruck | Preclinical Thyroid cancer | ||||||||

| CCK2R | 3 | 177Lu-Debio 1124 | DebioPharm | Thyroid cancer Phase I | ||||||||

| CXCR4 | 3 | 177Lu-BL01 | University of British Columbia | Preclinical | ||||||||

| CXCR4 | 2 | 177Lu-Pentixather | PentixaPharm EZAG | Solid tumor cancers | ||||||||

| CD105 | 3 | 177Lu-DTPA-TRC105 | Tracon Pharma | Preclinical Angiogenesis | ||||||||

| CD37 | 3 | 177Lu-Humalutin | Nordic Nanovector | Preclinical – First Phase I study delayed for financial reason NHL | ||||||||

| CD37 | 2 | 177Lu-Lilotomab satetraxetan (Betalutin®) | Nordic Nanovector | Phase I/II completed in 2015 NHL | ||||||||

| CEA | 2 | 177Lu-IMP-288 | Nantes University | Phase I/II Lung cancer – Glioma Dock&Lock technology on hold | ||||||||

| Cell Death Ligand | 3 | 177Lu-APOMAB (177Lu-DAB4) | AusHealth Corp Pty Ltd / Telix Pharma | Preclinical Lung and Ovarian cancers | ||||||||

| Fibroblasts | 3 | 177Lu-FAP-2286 | Clovis Oncology 3B Pharma | Phase II | ||||||||

| FR – Folic receptors | – | 177Lu-cm09 | PSI | On hold | ||||||||

| Glucagon-like peptide 1 receptor | 3 | 177Lu-DOTA-Exendin-4 | Bhabha Atomic Research Center | Preclinical Insulinoma therapy | ||||||||

| HER2 | 3 | 177Lu-HP2 | Affibody | Preclinical Breast cancer | ||||||||

| Integrin RGD | 3 | 177Lu-EBRGD | MTTI | Preclinical | ||||||||

| Integrin RGD | 3 | 177Lu-FF-10158 | AAA/Novartis FUJIFILM | Preclinical Glioblastoma | ||||||||

| MC1R | 3 | 177Lu-DOTA-αMSH- PEG-C’ dots | Elucida Oncology | Preclinical Melanomas | ||||||||

| PSMA/GCPII | 3 | 177Lu-7E11 | Cytogen | Discontinued Prostate cancer | ||||||||

| PSMA/GCPII | 2 | 177Lu-CTT1403 | Cancer Targeted Technology | Phase I clinical trial initiated in January 2019 Prostate cancer | ||||||||

| PSMA/GCPII | 2 | 177Lu-EB-PSMA-617 | Peking Union Medical College | Phase I/II Prostate cancer | ||||||||

| PSMA/GCPII | – | 177Lu-FC315 | FutureChem | On hold – Replaced by 177Lu- FC705 Prostate cancer | ||||||||

| PSMA/GCPII | 3 | 177Lu-FC705 | FutureChem | Preclinical stage completed – early clinical stage entering Phase 0 (2020) Prostate cancer | ||||||||

| PSMA/GCPII | 3 | 177Lu-hu11B6 | Lund University | Preclinical stage | ||||||||

| PSMA/GCPII | – | 177Lu-ibu-DAB-PSMA | PSI | Combining ibuprofen as albumin-binding entity preclinical | ||||||||

| PSMA/GCPII | 3 | 177Lu-iPSMA | ININ | Phase 0 Prostate cancer | ||||||||

| PSMA/GCPII | 3 | 177Lu-L1 | Johns Hopkins University | Preclinical – Prostate cancer Lead from the series 177Lu-L1 to 177Lu-L14 | ||||||||

| PSMA/GCPII | 2 | 177Lu-PSMA-617 | University of Heidelberg – ABX Endocyte – Novartis | Phase III stage Prostate cancer | ||||||||

| PSMA/GCPII | – | 177Lu-PSMA-Ab06 (177Lu-Prostalucin) | ITM | No information available Prostate cancer | ||||||||

| PSMA/GCPII | 3 | 177Lu-PSMA-ALB-56 | ETH – PSI | Preclinical Prostate cancer | ||||||||

| PSMA/GCPII | 2 | 177Lu-PSMA-CC-34 | Generic | Phase I/II Compassionate use Prostate cancer on hold | ||||||||

| PSMA/GCPII | 2 | 177Lu-PSMA-R2 | Novartis/AAA/ John Hopkins University | First clinical trial initiated in May 2018 Prostate cancer | ||||||||

| PSMA/GCPII | 2 | 177Lu-PSMAI&T 177Lu-PNT2002 (177Lu-(l-y)FFK-(Sub- KuE)) | Point Biopharma Origin: University of Munich Scintomics | Prostate cancer Entered Phase III trial in December 2020 | ||||||||

| PSMA/GCPII | 3 | 177Lu-RPS-063 | Weill Cornell Medicine Progenics | Preclinical Prostate cancer | ||||||||

| PSMA/GCPII | – | 177Lu-RPS-072 | Progenics | Preclinical – DOTA chelating agent Prostate cancer | ||||||||

| PSMA/GCPII | 2 | 177Lu-TLX591 177Lu-Rosopatamab | Telix Pharma since 2017 | Phase II completed Phase III inclusion to be started in Q4/2019 Prostate cancer | ||||||||

| sstr | 2 | 177Lu-DOTA-EB-TATE | MTTI | Phase I trial results published in 2018 GEP-NET | ||||||||

| sstr | 3 | 177Lu-DOTA-LM3 | Bad Berka Klinik, Germany | Phase I | ||||||||

| sstr | 2 | 177Lu-DOTANOC | Generic | Under clinical trial as comparator – no real development – GEP-NET | ||||||||

| sstr | – | 177Lu-DOTA-X-TATE | MTTI | Appearing in earlier MTTI documents – exact name is 177Lu-DOTA-EB-TATE GEP-NET | ||||||||

| sstr | 1 | 177Lu-Edotreotate (177Lu-Lutathera®) (177Lu-DOTATATE) | Novartis/AAA | Approved in EU and US. GEP-NET | ||||||||

| sstr | 1 | 177Lu-PNT2003 177Lu-DOTATATE | Point BioPharma CanProbe | New formulation labeled with nca 177Lu | ||||||||

| str | 2 | 177Lu-Edotreotide (177Lu-DOTATOC) | ITM/ITG | Development restarted (Phase III) – GEP-NET | ||||||||

| sstr | 2 | 177Lu-HA-DOTATATE | Scintomics | Phase I – on hold | ||||||||

| sstr | 2 | 177Lu-IPN-1072 (177Lu-DOTA-JR11) | OctreoPharm Ipsen | GEP-NET and non-NET see detailed description below | ||||||||

| sstr | – | 177Lu-NODAGA-LM3 (177Lu-LM3) | GEP-NET | |||||||||

| VLA-4 | 3 | 177Lu-DOTA-LLP2A | University of Pittsburg | Preclinical Melanoma | ||||||||

It is estimated that the average patient dose could stay below 200 mCi per injection, but if referred to 177Lu-Lutathera, one should count 4 injections for a full treatment. This is about 20 times higher than a treatment with 211At and even 400 times higher than 225Ac. As a consequence, for an average 177Lu-radiolabeled product that targets about 100,000 patients worldwide, the yearly needs will be around 80,000 Ci. Taking in account the high number of 177Lu-labeled molecules under Phase II and III clinical trial stage and some very large indications such as prostate cancer, it is quite obvious that worldwide nca 177Lu production capacity should probably reach half a million curies per year by 2030 if not more.

Price:

By beginning of 2015, the competition led the sale’s prices of ca 177Lu to drop as low as EUR 180/GBq (below EUR 5/mCi) which means that it is possible to prepare patient doses in which the 177Lu content has a value below EUR 1,000.

However, by end of 2016, the non-negotiated price for ca 177Lu (pharmaceutical grade Lumark) sold by IDB was established at EUR 2,500 for a patient dose (estimated at 200 mCi at ART), i.e., EUR 12/mCi (US$13/mCi).

In 2016 high specific activity Lutetium i.e., nca 177Lu was more expensive than low specific activity i.e., ca 177Lu (around EUR 15/mCi – US$17/mCi or EUR 2,000-3,000 – US$ 2,200- 3,300 per patient dose compared to around EUR 10/mCi – US$11/mCi or EUR 2,000- 2,500 – US$ 2,200-2,700 per patient dose), but this was mainly due to the limited demand.

The price of ca 177Lu associated to 177Lu-Lutathera went very high in the US, but this is mainly due to a way of attributing a value to 177Lu (about US$ 12,000 per 200 mCi dose) in the drug price (about US$ 48,000 per dose), rather than providing a sale’s price. In 2020 the price of 177Lu stabilized around EUR 10-11/mCi with almost no difference between ca and nca 177Lu, but by mid-year 2020, ITM increased the price to about EUR 13/mCi (EUR 350/GBq).

A comparative evaluation performed in 2015 by the IAEA came to the conclusion that 177Lu should become a very cheap radionuclide. The current price is presently high, because it is commercially driven. If one considers the efficacy of irradiation and the yield of neutron bombardment of 176Lu targets, the amount of 177Lu that can be produced could theoretically reach more than 10,000 curies per gram target (compared to about 10 Ci/g for 99Mo). As a consequence, in the future, the price of 177Lu could reach the price range of 99Mo. The nca177Lu will remain at a higher price due to the limited sources of 176Yb, but could drop as well by almost the same proportion when labeled drugs will be on the market.

Issues:

Contaminants with half-life above 100 days are generally banned from hospitals, especially in Europe. In the case of 177mLu, this radionuclide does not generate specific health issues for the patient and the content in 177Lu solutions remains very low. Due to the high difference in half-life, the proportion of 177mLu in 177Lu increases quite rapidly over time (doubling every 7 days from EOB) and it is always recommended to use the freshest prepared 177Lu batch. 177mLu has a 61% β- emission at 153 keV and a 57% γ ray at 208 keV. In other words, 177mLu will behave similarly to 177Lu with an energy that is three times lower. Non-decayed 177mLu injected together with 177Lu will be excreted by the patients within a couple of days and the largest dose probably within the first 24h when the patient will still be staying at the hospital.

However, the long half-life of 177mLu (160.4d compared to 6.7d for 177Lu) will have a safety impact for hospitals as the product that will be found in the urine will concentrate and stay in the hospital waste tanks. A rough calculation shows that a patient dose of 190-240 mCi (7-9 GBq) of ca 177Lu contains in average 37-49 µCi (1.4-1.8 MBq i.e., 0.02 % 177mLu compared to 177Lu). The patient will excrete about 1.5 MBq 177mLu per dose in the urine, while the production of such a dose will generate additionally about 1-3 µCi (30-90 kBq) 177mLu waste at the level of the hospital radiopharmacy. The EU regulations request that radioactive contaminated liquid waste can be discarded in the water sanitation network under the condition that the volumic activity is below of 10 Bq/L. For 131I the acceptable limit is set at 100 Bq/L and for 177mLu the European radiation safety regulations have set the maximum permissible radioactive concentration at 50 Bq/L. In other words, to remain below this threshold, this means that radioactive waste water from the hospital waste tanks needs to be diluted significantly before discharging into the municipal sewage line. The presence of Lu is directly linked to the number of patients hosted at the hospital and the duration of their stay and might exceed the activity limits alone or with other nuclides (sum activity) in the radioactive waste water holding tanks. This must be evaluated in each case. The alternative would then be to treat the patients in an ambulatory way (like in the US).

In order to keep using the less expensive carrier-added 177Lu source, it could make sense to equip therapeutic rooms with specific individual toilets. The company IDB (now AAA) has even developed specific lutetium traps (Lu-sponges) that allow considerably reducing the 177mLu amount present in patient’s urine before discarding the remaining liquid in the waste tanks. These “sponges” will be stored as small solid radioactive waste separately, until full decay (which actually needs also some storage space and authorization to accumulate this radioactive waste).

Despite this issue, 177Lu will definitely become a pharmaceutical-grade radionuclide of high importance within the next years, either based on direct-route 177Lu for which the waste issue has been solved, or on slightly more expensive nca177Lu. By looking closer, it

appears that most of the groups and companies developing 177Lu-labeled drugs are already using nca 177Lu and the only drug that will remain on the market, labeled with ca 177Lu will be 177Lu-Lutathera. It is not excluded that Novartis will also have to switch to nca 177Lu, mainly to avoid competition with Lutathera generics labeled with nca 177Lu.

Data comparing ca and nca 177Lu-DOTATATE and published in 2014 were largely in favor of nca 177Lu: 8.6 times more absorption in liver tumor for nca 177Lu was observed compared to ca 177Lu. If this is confirmed for other 177Lu labeled compounds, this property will become a major differentiation factor in favor of nca 177Lu, on top of the waste issue.

Comments:

177Lu has emerged as a major radiotherapeutic nuclide. Its half-life is adequate, its energy is sufficient to destroy smaller tumors compared to 188Re or 90Y, and it decays with a gamma ray that will allow biodistribution imaging, which is not possible with 90Y.The advantage was initially given to the Lumark (IDB/AAA) product which was for a period of 18 months the only 177Lu solution with a marketing authorization. Since mid of 2016, there is now a real competition between Lumark and EndolucinBeta as both have a MA for labeling. No price war is expected as there is a major quality difference between both products. However, unless no carrier added quality is mandatory, authorities in Europe will not accept the use of any other product in a trial as these approved products satisfy entirely to the European pharmacopeia. In fact, the pharmacopeia does not differentiate the 177Lu solution qualities and there is a description of two specifications (related to the route of production, without clear statement to ca or nca qualities) but both are under the same heading. Officially at the present time there is only one single quality of 177Lu described. This situation will hold as long as the pharmacopeia is not updated with convincing data demonstrating the necessity to split the product description in two (which will probably take years).